What’s the gasoline price these days?

Says here that the average fuel price across the country for regular gas is $3.982. If you’re buying the medium-grade or premium fuel, you’re over $4.00. If you’re stuck buying that E85 crap, it’s $4.40.

It’s May. We all know that prices by July or August will be well beyond the record.

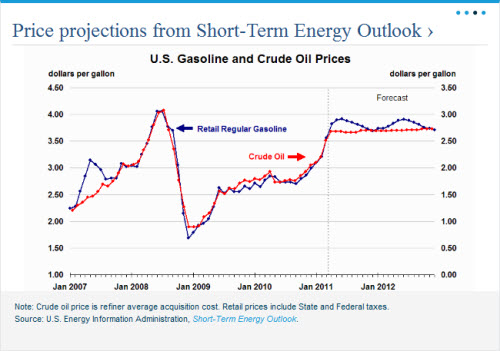

Will this slack off anytime soon? No. Why should it? Gasoline prices are a direct reflection of crude oil prices. As Steve Maley noted at RedState.com last night, you can pretty much add $1.00 to the price of crude oil per gallon (which is 1/42nd of the price of crude per barrel) and you’ll get the price of gasoline. Steve even has a graph to illustrate the relationship…

Once in a while you’ll see the two depart from each other. Only a little, though. Generally speaking, when crude goes up gasoline goes up immediately afterwards.

Once in a while you’ll see the two depart from each other. Only a little, though. Generally speaking, when crude goes up gasoline goes up immediately afterwards.

Our political leadership likes to attack the greedy oil companies and the speculators in the market for high oil and gasoline prices when they occur. Anybody with knowledge of how this market works knows that’s just so much boob bait for bubbas. It’s not the speculators, and it’s not the oil companies. Oil companies do somewhere between a seven and nine percent profit margin – if you’re a computer manufacturer or fast-food joint, 7-9 percent would make you pretty much the worst performer in your industry. Oil companies make bupkis compared to other industries from a margin standpoint. In gross figures, an ExxonMobil or a Chevron or ConocoPhillips will post eye-popping numbers, but nobody considers just how big an operation a company like that is and how expensive what they do might be. If ExxonMobil posts a $9 billion profit, you might think they’re raking their customers over the coals. But nobody bothers to note that the $9 billion which is such a monster number might reflect $109 billion in revenue against $100 billion in expenses.

This post, however, is not a defense of the oil companies.

The fact is that we have established a nearly 100 percent gasoline-based fuel matrix with respect to transportation in this country. Better than 90 percent of our fuel mix is gasoline or diesel, with a bit of ethanol mixed in as dictated by our politicians. Our fuel distribution infrastructure is based on that and our auto manufacturing industry is based on it, too. And that means that the vertically-integrated oil companies – the Exxons, Chevrons, BP’s, Shells, ConocoPhillipses and the rest – are in a position to drive the cost at the pump. Which they do, subject to THEIR costs. Like the price of crude, and the cost of refining, and marketing, and taxes.

It so happens Steve has another graph addressing those numbers.

It so happens Steve has another graph addressing those numbers.

What we have is a supply problem. Everybody knows this. The Obama administration certainly does. They knew it when they squawked about running the price at the pump up to European levels before the election – something the legacy media was nice and quiet about for fear that their guy would get blown out of the water that year if it was widely known that this Messiah we were going to elect would make the unacceptable, record gas prices of the Summer of 2008 a permanent feature of the U.S. economy.

And they know it now, because since their activities in squelching domestic oil production have produced the current prices and as a result an economy grinding to a halt – and the predictable political consequences which follow – they’ve gone begging around the world for increased supplies.

First, there was the laughable spectacle of the president in Brazil touting that company’s future as a supplier of oil while standing in the way of domestic production.

And since then, we’re now begging the Saudis for increased production. To no avail, mind you – the Saudis like the price exactly where it is, and they’re certainly not interested in doing Obama any favors after he threw their friend Hosni Mubarak under the bus in Egypt. That action made for internal turmoil for the Saudi royals, it wiped out a government they were allied with and it strengthened Iran’s position in the Middle East at the Saudis’ expense. They’re not happy, so they told us to screw ourselves when we went to them.

And the crude price now sits at $108.47, which is down just a little today. It’s been hovering around $110 for a while, and the general trend is steadily up. Particularly over the last year (these are gasoline prices, but remember, crude prices and gasoline prices move pretty much in lockstep)…

Talk to your average lefty, and you’ll hear them tell you how terribly unacceptable all this is. The economic illiteracy involved in their emotional outbursts will come through loud and clear, mind you. And as a result, you’ll hear them prattle on about ethanol and electric cars. We’ve tried both. They don’t work. We’re building electric cars and nobody wants them, because they’re ridiculously expensive and because it’s completely impractical to drive a car which dies on you after 40 miles on the road. And ethanol trashes engines, makes for crappy gas mileage, isn’t economic, drives food prices through the sky, does environmental damage and makes for higher fuel prices. It’s an unmitigated loser.

But here’s the thing – the lefties have a point in spite of themselves. We shouldn’t have to be completely dependent on oil as a transportation fuel. We should have other options so as to make for a more robust, competitive market.

The problem the lefties run into is that they’ve already picked the winners. They like ethanol and electric cars. They say it’s for environmental reasons, but that’s either horrendously disingenuous or tragically stupid. Neither of those solutions even remotely serve environmental purposes. With ethanol, you’re spending more energy turning corn into fuel than you’re getting out of that corn at the end. And electric cars draw power off the grid – which means you’re burning more coal, which they hate.

Or natural gas. Because if you’re going to do what President Obama says and put a million electric cars on the road, you’re going to need a larger power grid. Right now, about half the grid is powered by coal. Obama isn’t interested in more coal-fired power plants. He already said that’s not going to be possible. And after Fukushima you can forget about fast-tracking any nuclear plants.

And that means all these electric cars will run on natural gas. The growth in our power grid infrastructure has to come from natural gas, because it’s the only option available if you’re not increasing your use of coal or nuclear power. It certainly isn’t coming from wind or solar power; were that to happen we’d be broke like Spain and nobody would have money to drive their cars or a job to drive them to.

So if moving away from oil as our only real option for transportation fuel means we’re going to use natural gas, why would we put up with poorly-performing electric cars as the result?

Natural gas will fuel automobiles. In fact, it does a damn fine job of it. And as it turns out, compressed natural gas as a transportation fuel comes out to about half the price of gasoline if you measure it as a gallon of gas equivalent (GGE). In California, the GGE price of compressed natural gas runs from $2.10 to $2.70, but in most places it’s around $2.25. And that means you’re probably looking at a price savings of almost 50 percent if you run your vehicle on natural gas. And in Utah, where there are 90 CNG stations, the price is unbelievably low – anywhere from $1.00 to $1.30 GGE.

CNG as a fuel is actually safer than gasoline is, which is a fact the public needs to be made aware of. As a higher-octane fuel, it burns cleaner than gasoline does. The gas mileage you get running on CNG is comparable, if not better, than that of gasoline. The only real downside is that your fuel tank for CNG has to be bigger than that for a vehicle running on gasoline.

Across the world, some 9 million vehicles run on natural gas. There are 2.4 million of them in Pakistan, which is a country where they can’t hardly do anything right, and 1.9 million of them in Argentina. If those Third World places can make natural gas vehicles work, we certainly can. We’ve already got about 110,000 natural gas vehicles in America, most of which are buses and trucks.

The vast majority of vehicles running on CNG in America are city buses. The only consumer vehicle currently in production to run on CNG is a Honda Civic, and the demand for that niche product has skyrocketed. In the Utah example noted above, where the CNG price is rock-bottom, there are some 5,000 privately-owned NGV’s (natural gas vehicles) and growing. In other countries, a conversion kit to transfer vehicles from gasoline to CNG can run as low as $1,500. Here, thanks to EPA regulations and the lack of a mass market for the kits it’s anywhere from $6,000 to $7,500. But if the demand for those kits were to expand, just like in any other endeavor you’d see competition drive down costs and drive up technology and quality.

All of those are market-based evolutions which the economic benefits of natural gas – again, your cost at the pump is HALF what it is for gasoline, there is no refinery process associated with CNG; what goes into your tank is more or less what comes out of the ground, and it’s a fuel we can produce here in America and by using it reduce our trade deficit and strengthen our dollar – will drive without the government mandating it. We don’t need to create some elaborate cap-and-trade structure to force consumers to move to natural gas. We don’t need to do what Obama and his Energy Secretary Steven Chu have talked about doing; namely driving the price of gasoline to the $7 or $8 a gallon they’re paying in Europe, to somehow make CNG a viable vehicle fuel.

No, the market will ultimately drive us to natural gas as a transportation fuel.

Why hasn’t it happened so far? Well, that’s simple.

We have a transportation fuel system based on gasoline. Billions and billions of dollars, and retail empires, have been built off gasoline. ExxonMobil, for example, is almost suicidally invested in gasoline. Go to Exxon and tell them “OK, you need to run natural gas lines to all your stations so you can set up compressors and sell CNG for half what you sell gasoline for,” and what you’ll get is a guy with his head in his hands, shaking it and saying “Not a chance, pal.” Not to mention the fact that downstream producers like ExxonMobil, Valero and the like use natural gas as a feedstock to power their refineries. They’re not really all that crazy about coming up with other uses for natural gas, to be honest. Think about it – you’re Marathon Oil, let’s say. Why would you want to embrace CNG as a transportation fuel when that will deflate demand for your core business while driving up your own energy costs? That sounds like a bad plan to you.

There are 150,000 gas stations in the country. There are 800 CNG stations, most of which exist to service the city buses and municipal fleets which already use CNG as a fuel (this is another entire post, but if the federal government grew a brain and decided to buy conversion kits in bulk to move its 600,000-vehicle fleet to CNG, you’d see some major upward pressure on the supply side, particularly in the Virginia-Maryland-DC area and you’d also see significant cost savings within 2-3 years). It’s not going to happen that the major gasoline retailers will make the investment to bring up those CNG numbers. And until there are more than 800 CNG stations, you’re never going to see a large market for the CNG vehicles this country needs and simple economics dictates will ultimately come about.

What’s going to have to happen to get those numbers to change is that new players will have to enter the market.

But there are lots of those, as it happens. Companies like Chesapeake and Apache would love to put up CNG stations – because that $2.25 GGE is a hell of a lot better price at the pump than the $4.35 per million BTU’s reported out of NYMEX last week.

But just like the EPA’s regs have made it impossible to sell conversion kits at a similar price to what Third World people can get them for, the tax code makes it impossible for Chesapeake and Apache and all the other independents who are producing a ton of natural gas nowadays to push the supply side of the natural gas-as-transportation-fuel sector.

Why? Because the tax treatment of independents is a lot different than that of the big oil companies. Current tax law provisions contained in section 613(a) of the Internal Revenue Code of 1986 define an “independent producer” as a firm whose refining capacity is less than 75,000 barrels per day or their retail sales are less than $5 million for the year. And as such, a Chesapeake, who drills for and moves natural gas almost exclusively in wholesale fashion, can qualify as an independent. Compare that to Chevron, for example; they explore, they drill, they produce, they move, they refine and they truck to gas stations where they sell oil to you at the pump.

So under the tax code, an independent like Chesapeake or Apache, for example, can get a tax exception for percentage depletion and breaks for intangible drilling costs. Because they’re not in the retail game. And they’re not going to get into the retail game right now, even though they’d like to, because it’s not worth their while to do something that would move them from being classified as independents to being classified with the ExxonMobils and BP’s of the world when their business model is totally different.

They’d like to get into the retail game, though. Because retailing CNG could be hugely profitable. Bear in mind, they’re laying natural gas pipelines like crazy all over the country right now. It’s a big investment to lay them to fueling stations on street corners, but it’s not prohibitive. And once that infrastructure is built and some demand shows up, these guys are pumping natural gas straight from the ground to your fuel tank. Go back to Steve’s price breakdown graph above. Of a $3.56 per gallon price average in March of this year, 81 percent – $2.88 – goes to crude prices (68 percent) and refining (13 percent). Natural gas production is far cheaper than is oil production, and there is no refining cost. And as such, that 7-9 percent the oil companies grind out as profit could be chump change compared to what a natural gas retailer could make.

And what’s more, there’s only one natural gas retailer in the market of any real size – a company called Clean Energy, which has lots of stations in California, a decent number in the Northeast and a smattering in Nevada, Arizona, New Mexico, Colorado and Texas. What that means is it’s largely a virgin market. Investors like virgin markets.

So while a lot of work needs to be done on the demand end by getting the EPA out of the way and letting entrepreneurs and manufacturers develop the conversion-kit industry to make consumers interested in moving their vehicles to CNG from gasoline, what needs to happen on the supply side is to make it a lot easier for the people who produce natural gas to bring it to the retail market.

Rep. Bill Cassidy (R-LA), who has in three years in Congress developed a reputation as a solid expert on fuel markets and energy, has proposed a change to the tax code which would address this issue. Cassidy’s “Job Creation and Energy Security Act of 2011,” co-sponsored by the other six members of Louisiana’s House delegation, might have a grandiose title not suited to a very simple change to the tax code. The bill would add a single sentence to Paragraph (2) of section 613A(d) of the Internal Revenue Code – namely, that ‘‘Sales of natural gas, or any product derived from natural gas, for use in motor vehicles shall not be taken into account for purposes of this paragraph.’’

Just like that, the independent natural gas producers wouldn’t face this $5 million in retail sales barrier which keeps them from retailing CNG. They’d be free to take a crack at selling their products without getting pounded by the IRS for their trouble.

Or – get this – you might not even need to pull into a CNG station most of the time unless you’re on a road trip. Because if you heat your home with natural gas, you can install a compression station in your garage and fuel your ride at home. Those stations currently go for $6,000, which make them a little cost-prohibitive, but once again we’re talking about a boutique product whose cost would drop off considerably if its use was more widespread. And it can be; just think, for example, about the fact that in 2003 70 percent of new single-family homes were hooked up to natural gas as a heating source. That’s a colossal market, though it’s a second-stage market because you’ll need enough fueling stations on street corners to move CNG into the mainstream.

Which is what Cassidy’s bill aims to do.

The Republican Study Committee, which is the House Republicans’ conservative policy shop, has jumped in behind the bill. That alone gives it a decent shot at getting passed. There really isn’t much reason why the Democrats ought to be opposed to it, but the word is they are. Why? Because natural gas as a transportation fuel kicks the hell out of electric cars and ethanol, and they’re politically invested in those with large corporate and other constituencies who have been backing them.

And those constituencies – to include the reticent oil companies that Democrats say they hate, and the auto companies whose manufacturing plans would go out the window if demand spiked for CNG vehicles, are the ones who won’t like the sea change natural gas could signify within the transportation market.

But CNG is the future. Oil prices aren’t going down anytime soon, and the 150 billion barrels of available oil aren’t going to be unlocked anytime soon. We’ll always need oil, even if we were to abandon gasoline as a transportation fuel. Petroleum has so many uses outside of gasoline it’s mind-boggling; that won’t change. CNG allows us to get off foreign oil, save money and open up an entirely new economic sector (or sub-sector, if you prefer) without the need for a single subsidy or corporate welfare regime. All it needs is some deregulation and subtle changes to the tax code and it will grow organically.

The question is whether our politicians – on whose shoulders so much of our economic and energy problems rest in the first place – will agree to get out of the way and let the market evolve. If they do, in 10 years your vehicle might very well run on compressed natural gas – and your fuel dollar will not only go further, it will stay in America.

Advertisement

Advertisement