In case you haven’t paid much attention, Blue Cross/Blue Shield of Louisiana is in the midst of attempting to merge with a company called Elevance Health. Yesterday there was a meeting of the joint legislative committee on insurance to discuss Elevance’s acquisition of Blue Cross, and it went on for six hours because the legislators, particularly a number of Republicans were very skittish about the deal.

And, as it turns out, they’re not necessarily wrong.

For those who aren’t fully up on what Blue Cross is, it’s a national association of health insurance companies who all fly under the same banner and work, essentially, on a territorial basis. Louisiana Health Insurance Company, a non-profit corporation, is the Blue Cross standard bearer here, and it’s branded as BCBSLA.

Outside of Louisiana a much larger for-profit company, formerly known as Anthem, carries the Blue Cross banner in a host of states – 14 to be exact. Anthem has been on a buying binge for quite a while and has changed its name to Elevance Health. Now they’re aiming to swallow up the Louisiana provider.

So you’d still be buying a Blue Cross plan, but you’d be buying it from a lot larger company than you currently are. And that company would be a for-profit outfit. Though Elevance does plan on setting up a multi-billion dollar benevolent foundation with the proceeds of the sale.

Is this a good thing? Maybe. Elevance boasts state-of-the-art technology, which it’s thought would result in better customer service and other benefits.

But the legislators want to put on the brakes for this deal, perhaps mostly because if it goes through now you’ll have a new governor and a new insurance commissioner essentially having its effects dropped into their laps without much input. Given that Tim Temple was just elected as the new insurance commissioner, a product of his Democrat opponent Rich Weaver dropping out of the race, you’d say that he should perhaps be allowed to weigh in.

Current insurance commissioner Jim Donelon is taking a deliberate approach toward this thing. It has the potential to become an explosive issue, given that insurance in Louisiana as a whole is a bear of an issue – rates for auto, home and health insurance have all been the subjects for wholesale grousing, and what public feedback there has been so far on this deal has been highly skeptical.

State senator Kirk Talbot, who chairs the insurance committee in the Senate, perhaps said it best last week. “We’re going from a nonprofit to a for-profit company and rates are going up every year as it is,” he said. “That scares the hell out of me.”

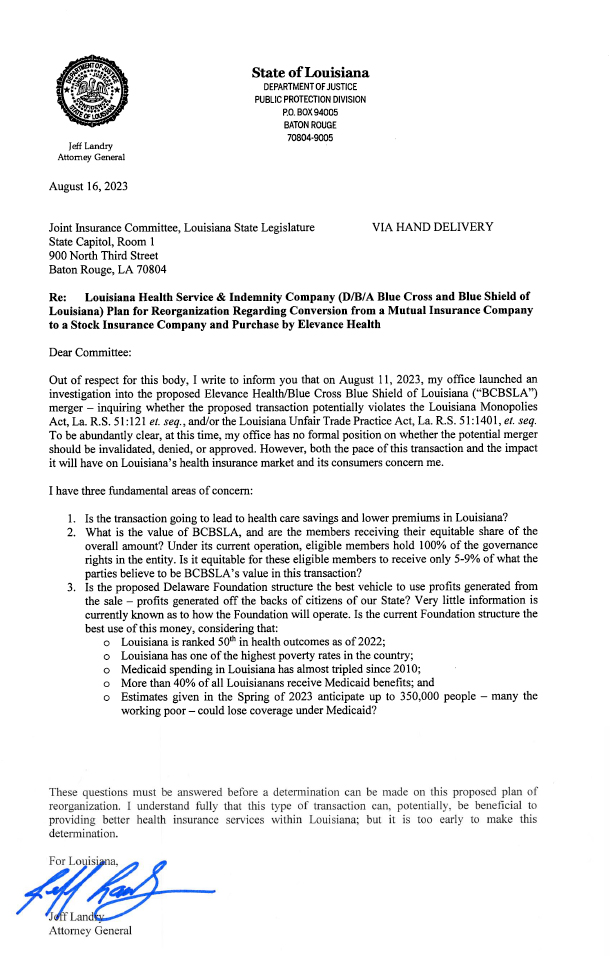

And Attorney General Jeff Landry, who at this point looks very much like the frontrunner to be governor next year, sent a letter asking for the brakes to be put on this deal.

Landry isn’t taking an antagonistic position on the deal yet, but he, like Talbot and the others, is skittish.

And Blue Cross’ CEO, Dr. Steve Udvarhelyi, really didn’t do much to make those concerns go away when he said this…

“There will be no changes. There will be no layoffs. But if we do not something now to secure our future, the forces at play in the marketplace, the inevitable forces of consolidation, will happen and we will have to consolidate from a position of weakness. We believe we are in a unique moment in time.”

Advertisement

“The inevitable forces of consolidation?” What the hell?

Today’s Hayride Quote Of The Day is from Temple, and he’s saying the opposite…

“At the end of the day, ladies and gentlemen, it’s competition. No insurance company has to do business in the state of Louisiana. It’s a free market. It’s supply and demand. We’ve overregulated, and overregulation is part of what got us to where we are today.”

Competition. Not consolidation.

Where Anthem has moved in and dominated the health insurance market in given states, they’ve jacked rates up for small businesses by as much as 50 to 60 percent. Now, everybody associated with this deal assures us that won’t happen.

But here’s the thing: you’ve got about four and a half million people in this state, and at least half of them are on either Medicare or Medicaid. Blue Cross has another 1.9 million people in its plans.

So the health insurance market in Louisiana is about as consolidated as it can get as is.

The last thing we need is a monopoly owned by an out-of-state for-profit company which then has to be regulated top to bottom by the state. You’d then have government-run Medicare for the old folks, government-run Medicaid for the poor folks, and government-controlled Elevance Blue Cross for everybody else.

That’s government-run health insurance, folks. It might be triple-payer health care instead of single-payer, but that’s a distinction largely without a difference.

So what we’d say about this merger is that if it’s going to happen, OK, but in that case Temple’s number one priority will be to find ways to spark up new health insurance carriers to eat into this burgeoning “consolidation” of the market and give consumers just a little bit of choice on health insurance.

And the state legislature, and perhaps Gov. Landry, will have to do everything they can to rebuild a viable, competitive health insurance market. That won’t be easy, as it’ll involve combatting the “inevitable forces of consolidation.”

Advertisement

Advertisement