Last weekend, the Advocate ran an editorial bemoaning the return of Louisiana’s frequent visitor, the so-called “fiscal cliff…”

After a flush stretch, the new fiscal cliff that has been on the horizon since then is right in front of us. When the temporary taxes expire a year from now, it will knock more than $660 million off the books. Already, colleges and universities have been told to plan for a $250 million drop in revenue if lawmakers don’t act.

We urge officials to take this opportunity to do some serious thinking and legislating to fix the state’s convoluted tax laws, rather than seek out yet another short-term fix. And after an initial presentation by Revenue Secretary Richard Nelson, there is some cause for hope.

Last year, Nelson built his gubernatorial campaign around an oversimplified claim that Louisiana is losing population because it has a state income tax. When his campaign foundered, he quit the race, endorsed Jeff Landry and ultimately joined the new ideologically driven administration.

But slogans aren’t going to get us to stability, and we’ve seen ideological tax policy before and know where it can lead. So it was a pleasant surprise recently to hear Nelson offer a realistic take on the available options.

Nothing in that editorial mentioned a word about who’s actually responsible for this “fiscal cliff.”

And today, following a two-hour joint meeting of the House Ways and Means and Senate Revenue and Fiscal Affairs Committees that Secretary Nelson addressed yesterday (it’s worth a watch if you have the time; see it here), we thought we’d offer a little bit of help with that.

His name is John Bel Edwards.

There’s a fundamental lie being told around this supposed $558 million “fiscal cliff” that Louisiana faces next year when a 0.45-percent state sales tax hike passed through the Louisiana legislature in 2018 pursuant to Edwards’ demands rolls off the books.

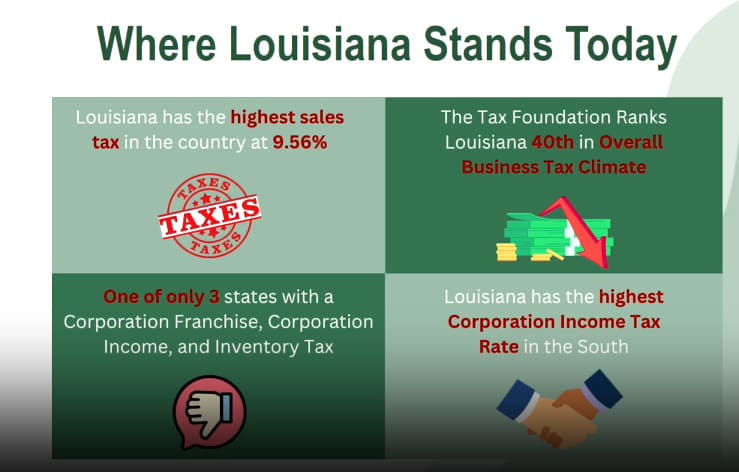

Namely, that Edwards’ hiking of Louisiana’s sales tax rates – which has made this state’s combined sales and local tax rates to an average of 9.56 percent, the highest sales tax burden in America – did not come by necessity, and thus the “fiscal cliff” Louisiana faces now and also faced in 2016 and 2018 when Edwards decided to browbeat the public and the state legislature into raising taxes has been and is now a product of his failed governance.

John Bel Edwards doubled Louisiana’s state budget. Much of that is a function of the flood of federal dollars washing over Louisiana over the past decade, but the state-effort portion of the Louisiana budget has also ballooned.

We can blame Louisiana’s Republican-majority legislature for going along with this bacchanal, and we should. But in the eight years prior to Edwards’ time in office, when the much-maligned Bobby Jindal was governor, the effort was to ratchet down Louisiana’s state government spending.

Jindal’s administration was attacked for its use of “one-time” money to plug budget holes, and for frequently sweeping money out of the various overfilled dedicated funds into the general fund. Not much of that process was clean or perfect, but the trend was toward a smaller state government.

When Edwards took office as governor, after voting for Jindal’s budgets in six of the eight previous years when he was a state representative and after promising the voters that he wouldn’t demand any tax increases, he immediately padded the state budget and declared a billion-dollar “fiscal cliff” that had to be compensated for by massive tax hikes.

From a slide Nelson put up yesterday at his presentation, here’s what that resulted in…

Much of that existed prior to Edwards. He absolutely made it worse.

And the effect of this? We’re fourth from the bottom in economic competitiveness.

Today, CNBC ranked Louisiana 47th in the country for business.

This is unacceptable and NOW is the time for change!

In order to bring Louisiana from the bottom to the top, we must simplify and refresh our tax structure.

Today, Secretary @larevenue @NelsonforLA laid out a…

— Governor Jeff Landry (@LAGovJeffLandry) July 11, 2024

And in net outmigration we saw an utter disaster over the eight years of Edwards’ run as governor, with well more than 100,000 people hitting the roads for Texas, Florida, Tennessee and over places where capital and people with means are not treated as prey.

Landry essentially hit the brakes on state spending when he took office, instituting about $3 billion in “cuts” to the executive budget he sent to the state legislature this spring. That had a positive effect on the “fiscal cliff” the state faces when the sales tax hike rolls off, but it isn’t enough.

Advertisement

So there will likely be more cuts.

Nelson is working on some significant tax reforms, though what he’s trying to do isn’t to eliminate the state income tax at this point but rather to flatten it, dump incentives and loopholes, and make the tax system less complex and more competitive.

That’s good thinking, as it involves something we never saw for the eight years John Bel Edwards was governor. Namely, an emphasis on finding ways to grow the state’s private-sector economy.

Edwards never gave a damn about that. For eight years there was almost nothing done to create jobs in the state. The joke was that every summer he’d pray for a hurricane, because federal hurricane recovery dollars were the bulk of the capital investment he could attract to Louisiana.

You get fiscal cliffs when your state’s economy grows more slowly than your budget. Edwards created his first fiscal cliff by artificially inflating that budget and demanding the people of the state pay a higher price for government to cover the cost. And the fiscal cliffs thereafter are merely the effect of returning the tax burden to normal.

So when the Advocate offers backhanded compliments to Nelson based on his recognition of “reality” – that he can’t get rid of the state income tax because of the “fiscal cliff” – just remember that they’re hiding the truth from you.

Nothing about Louisiana says we have to have the highest state and local sales tax rates. Or that we have to have the second most onerous corporate income tax in America. Or that we have business utility, corporate franchise, and inventory taxes which are poison for the growth of commerce and industry in the state.

We chose all this. We chose an onerous, overcomplex and stultifying tax code at a time when our neighbors are beating us to death with the opposite effect. And for the eight years previous to this one we had a governor who only cared about how much he could feed the public-sector beast.

Nelson is asking for a legislative special session before August 23 to do tax reform. If that were to happen, what changes would be made could go in front of the voters this fall. And that would give us an opportunity to become competitive with our neighbors after eight years with our heads in the sand.

Advertisement

Advertisement