Last week, the Louisiana state legislature met for its 3rd special session of the year. This time around, Governor Landry called the legislature in to address the state’s burdensome, uncompetitive tax system.

At face value, Landry’s proposal seemed to make sense. After all, who wouldn’t want to improve Louisiana’s cumbersome tax system? Well, the “devil is in the details” as the saying goes.

A few months ago, Governor Landry and Richard Nelson–the Secretary of the LA Department of Revenue–started previewing some of the primary components of a potential tax reform plan to legislative committees and to the media. However, myself and other writers here on The Hayride noticed the lack of specifics and several troubling parts to the “tax reform” plan. Overall, Nelson’s tax reform is more of a “tax swap” than a “tax cut” due to the plan’s revenue-neutral approach (i.e. collecting the same amount tax of revenue).

On Governor Landry’s website, we find some background as to the purpose:

“The Executive Budget presented earlier this year warned that the last administration relied on one-time federal COVID relief spending in both direct revenue and temporary increased tax collections to fuel massive spending.

As a result of their decisions, not ours, and impending statutory revenue impacts, the State is now facing a serious budget shortfall on our doorstep.

With the legislators hard work this past session we reduced the state budget spending by $2 billion over the previous administration’s last budget. In that vein, Governor Landry’s administration continues to urge all agencies to find savings as we work with the legislature to protect taxpayers and create a more sustainable state budget.

However, even with these reforms, more must be done. The impending budget shortfall is creating a crisis that must be addressed now.

This shortfall is projected to be upward of $737 million now.”

There seems to be some conflicting messaging about the tax reform plan. Are we addressing the supposed “fiscal cliff” in next year’s state budget or are we cutting taxes in Louisiana? You can’t really have it both ways, but I digress.

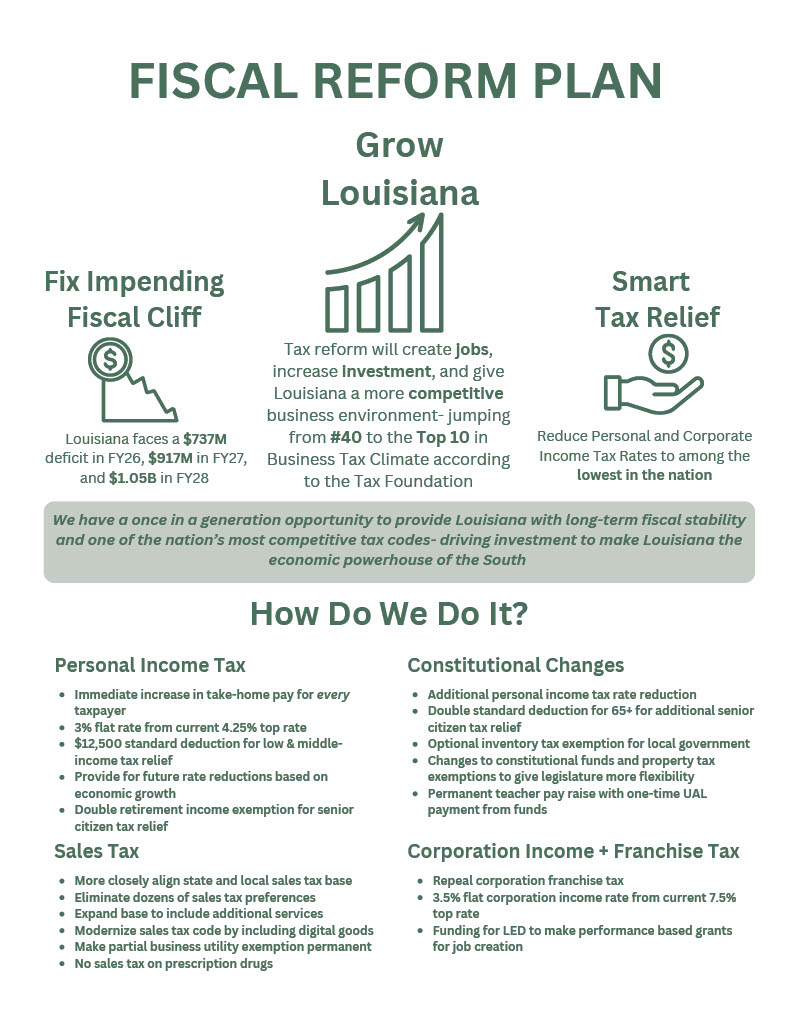

Governor Landry’s website also provides the following graphic of the “Nelson Tax Swap” plan–which conveniently does not give much detail about the less popular parts of this tax plan.

Here are some of the concerning parts of the “Nelson Tax Swap” plan:

-Extending the John Bel Edwards’s era .45% sales tax increase (~$500 MILLION/year in taxes)–HB 9

-Increasing the sales tax on more services in Louisiana (~$880 MILLION/year in NEW taxes)–HB 10

-Adding sales taxes to digital goods & software products (~$40 MILLION/year in NEW taxes)–HB 8

Yes, we are getting new taxes in Louisiana if the above bills pass. Louisiana residents would pay billions in new taxes.

Now, there are some positive aspects of this tax reform package, such as flat state income tax (HB 2), eliminating the business franchise tax (HB 3), implementing an annual spending limit for the state legislature (HB 13 & HB 14). However, the Louisiana public is not getting the full picture in much of the Nelson and Landry’s messaging about the tax reform plan. We’re being told that Louisiana is getting a “tax cut,” but the plan is also “revenue-neutral.”

Overall, the fundamental issue with the “Nelson Tax Swap” plan is that it deals with one side of fiscal equation. This plan deals ONLY with tax policy, and does nothing to deal with Louisiana’s out-of-control state budget.

In the past decade alone, the Louisiana state government’s budget has nearly doubled, all while the state’s population has been shrinking. Year after year, our state government continues to depend on federal government aid, wasting our tax-dollars on legislators’ pet projects, and making Louisiana’s business climate intolerable. Our state’s ever-growing budget has not led to widespread prosperity in our state, and it’s finally time to point out the proverbial “elephant in the room” with Republicans now fully controlling our state government.

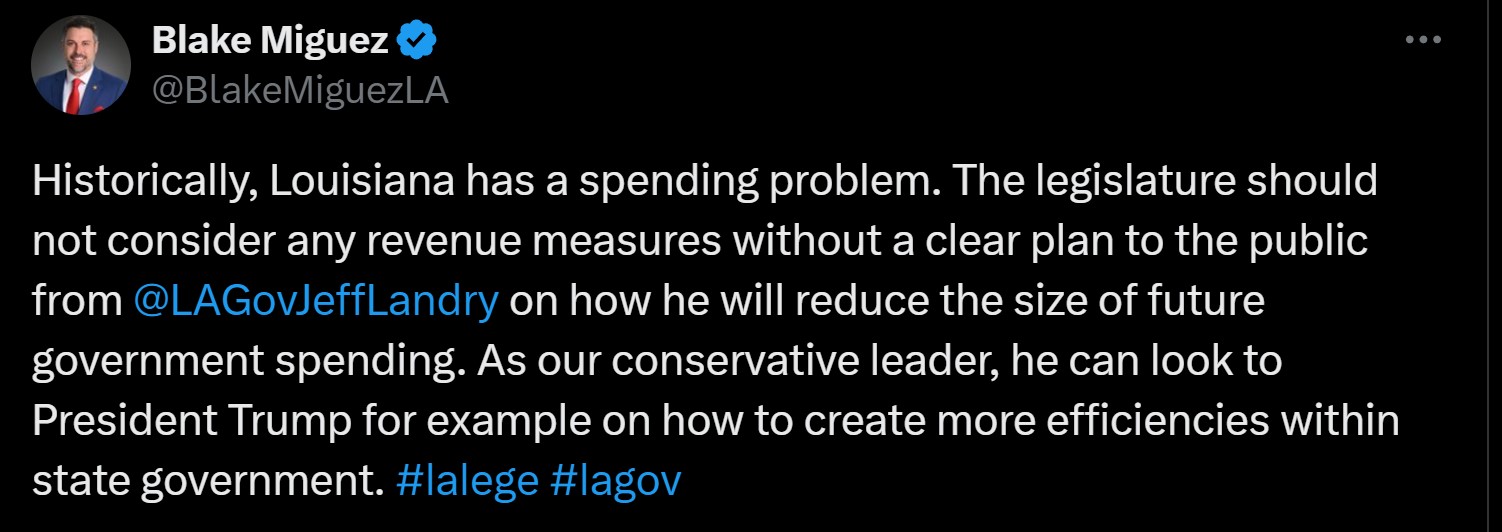

Fortunately, several conservative members in the Louisiana legislature have raised questions about the concerning parts of this tax reform plan—specifically the lack of focus on the government spending. Yesterday, conservative state senator Blake Miguez made a reasonable post on the X platform.

To many people’s surprise, Governor Landry took offense to Miguez’s post. Landry attacked Miguez, dishonestly so in the way of his character, without addressing Miguez’s valid concerns.

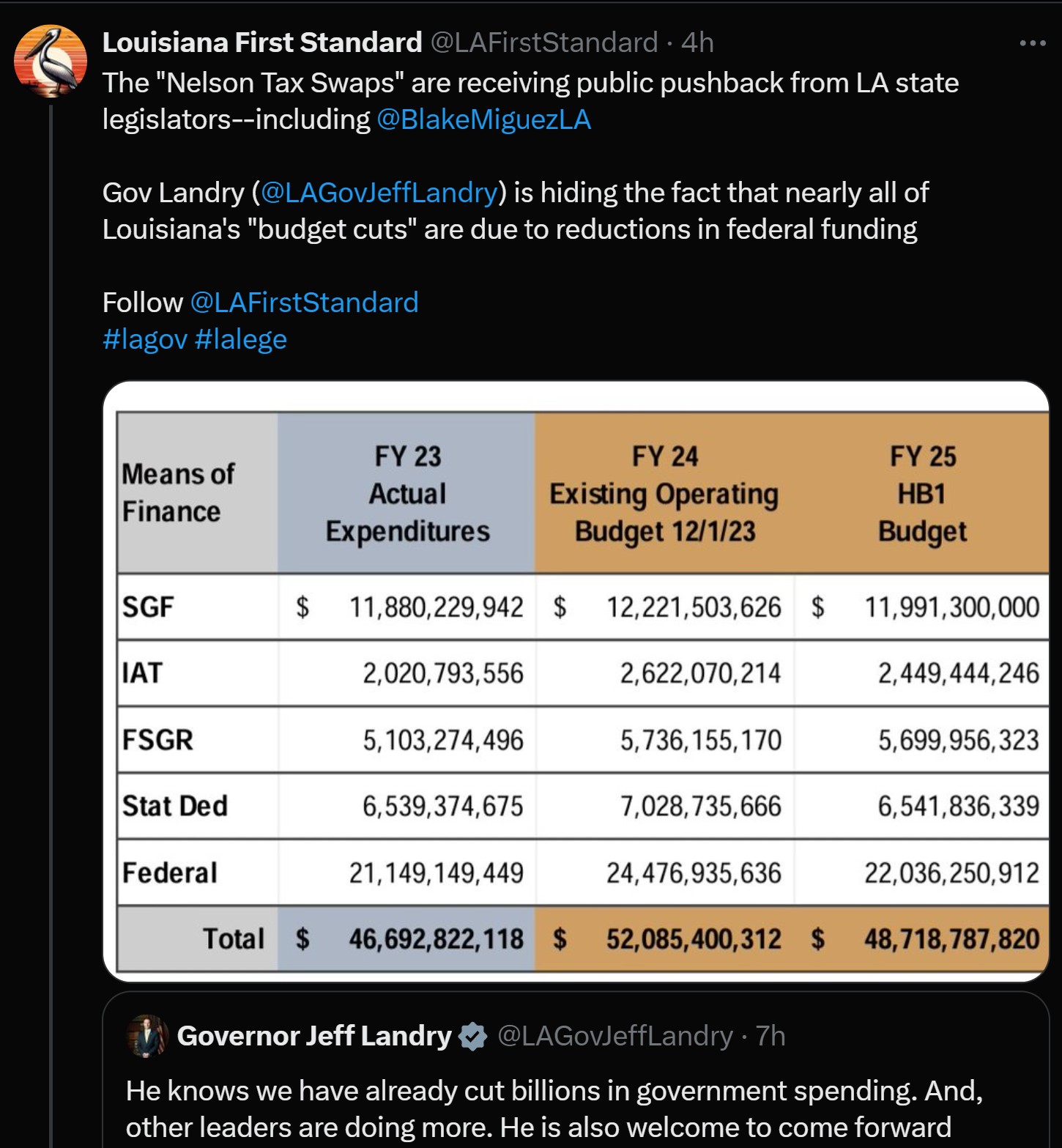

In his invective against Miguez, Landry claimed that he “already cut billions in government spending.” He provided no source in his post, so I decided to do some digging.

After a bit of research, I figured out that Governor Landry is not telling the whole truth here. What Landry failed to share is what actually caused the $2 billion year-over-year decrease in this year’s state FY 2025 budget. The answer: less federal funding.

So no, Landry did NOT cut billions from the state budget as he claimed. The scaling back of the Biden-era Infrastructure plan (2021)/COVID-relief money is what caused Louisiana’s latest budget to shrink.

In an unexpected twist, this tax reform session may be showing some major cracks in Landry’s mandate as governor. Despite conservative voters giving Landry a mandate in last year’s gubernational election, Jeff Landry’s honeymoon phase is starting to end for many conservatives. His political mistakes are starting to compile, and voters are noticing. Giving Cleo Fields his own Congressional district was a bad start to 2024, and now we’re seeing Landry attack conservative state senators for asking basic questions.

This tax reform special session is more interesting than most expected already.

—

Nathan Koenig is a frequent contributor to RVIVR.com, a national conservative political site affiliated with The Hayride. Follow his writing on the Louisiana First Standard Substack, on Twitter (X) @LAFirstStandard, on Tik Tok @la.first.standard & on Instagram @lafirststandard. Email him here: louisianafirststandard@proton.me

Advertisement

Advertisement