The past few months have been an absolute financial nightmare for New Orleans. The New Orleans City Council and Mayor-elect Helena Moreno scrambled to create a band-aid solution for the estimated $160 MILLION budget deficit the city faces for 2025.

But like magic, that band-aid materialized over the past two weeks. Thanks to a not-so-tough Louisiana State Bond Commission, which two weeks ago gave its stamp of approval, the City Council secured a $125 million loan from JP Morgan Chase. Just like that, the Democratic-controlled Council voted to approve $125 million worth of “revenue anticipation notes” from JPM at an interest rate of 3.5%.

If you want a detailed recap of the events surrounding the 2025 “budget crisis” facing New Orleans, you can check out my article here on my Substack. But for today’s purposes, we’ll discuss the role of the Louisiana Bond Commission in rescuing the Big Easy.

For those who don’t know, the Louisiana Bond Commission is entirely comprised of Republican politicians–including, but not limited to, Gov. Jeff Landy, AG Liz Murrill, Sen. Cameron Henry, Treasurer John Fleming, Rep. Julie Emerson, and Secretary of State Nancy Landry. You can find the full list of members below for your convenience:

Last Wednesday (Nov. 12), the Bond Commission held a brief meeting to discuss New Orleans’s request for a $125 million loan amid the city’s budget crisis.

During the meeting, the Commission members failed to give any meaningful scrutiny to the city’s financial management. Not a single Republican on the Commission pressed the Council about the city’s multi-million-dollar revenue shortfall or City Hall’s wildly excessive overtime spending.

The toughest the questioning got was when Gov. Landry spent 10 minutes or so walking Moreno and City Councilman J.P. Morrell and Louisiana Legislative Auditor Mike Waguespack through the process of trying to impose fiscal discipline on the city in exchange for the state giving it a bailout.

But the Commission gave the City Council everything it wanted–an approved loan with oversight from the Louisiana Legislative Auditor’s office (LLA). That could certainly turn inconvenient, depending on what Waguespack and his people find, but all Moreno and Morrell care about is that the money keeps flowing – and it will, for now.

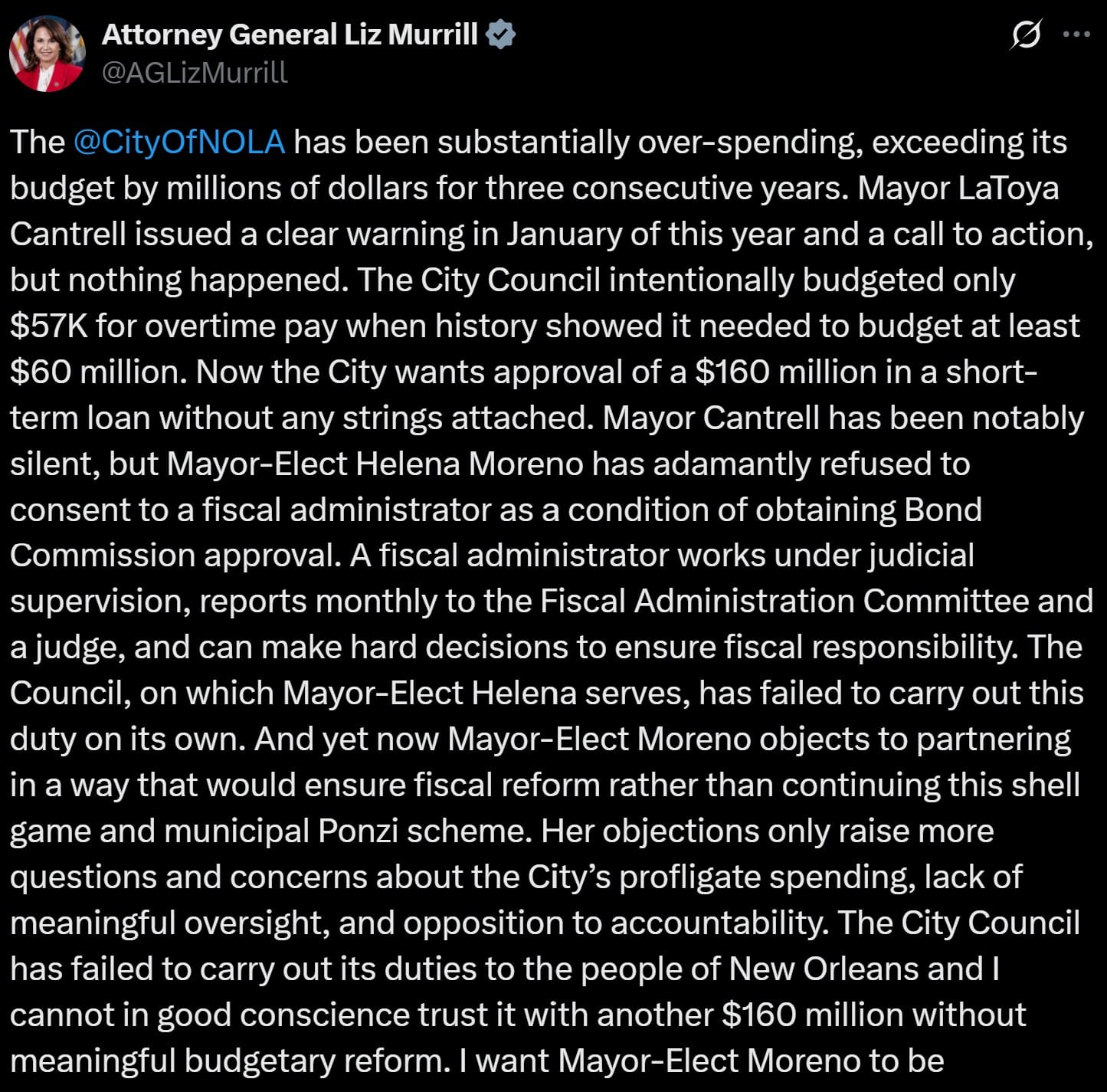

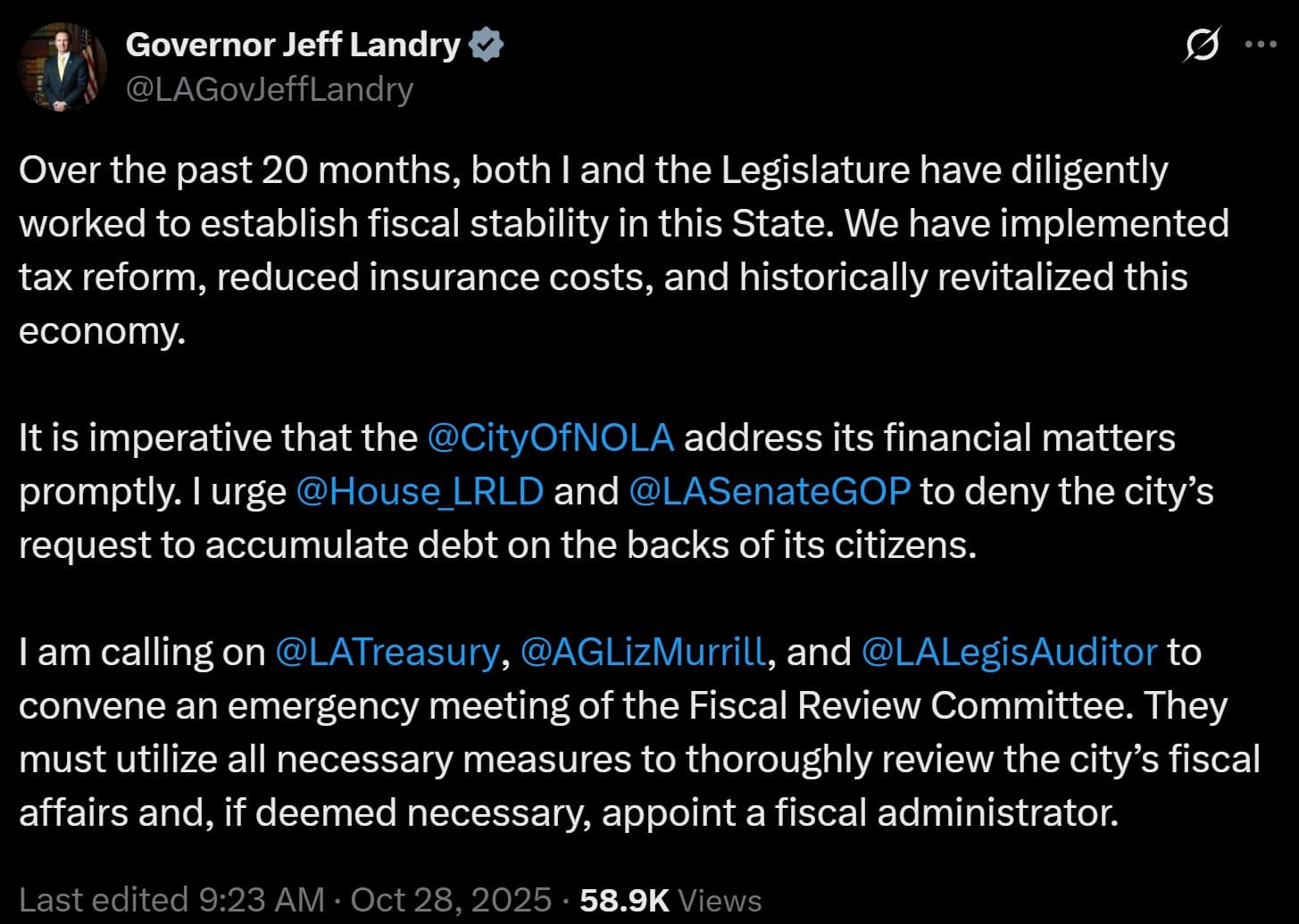

Before the meeting, Gov. Landry and AG Murrill had publicly voiced concerns about the spiraling fiscal issues in New Orleans. In fact, both Landry and Murrill explicitly requested the Commission to appoint a fiscal administrator over New Orleans in late October.

Landry wanted the Legislative Auditor involved in the oversight of the loan because he wants, essentially, a forensic audit of New Orleans’ finances. At the end of the day, though, he let up on his demand for a fiscal administrator.

But if the loan isn’t paid off, the next step would be to bring in a fiscal administrator. Landry hopes that if that step is needed, at least the LLA will have done that audit and can report back to the Bond Commission where the money has actually been going.

It’s safe to say the state hasn’t set up a particularly difficult set of oversight requirements on its municipalities who can’t competently handle their finances.

By the end of the meeting, the Commission voted unanimously to approve the city’s’ $125 million loan request. No fiscal administrator for now.

Hopefully this doesn’t turn out to be the same old political theater: empty promises, closed-door dealings, and minimal oversight. Hopefully this decision will result in an accounting of how New Orleans, with a budget of a little more than $800 million, could have put itself in the hole by almost 20 percent.

But it doesn’t give us any hard-and-fast guarantees on this problem getting fixed.

Maybe that’s asking too much. The voters of New Orleans put Cantrell and Moreno and Morrell in charge of the city; there is no reason to believe this mess will be fixed from below. And Landry, Murrill and the rest of the Bond Commission know taking on running the day-to-day finances of Louisiana’s big blue city is about as thankless, if not hopeless, a task as there is to take on. State Treasurer John Fleming, who chairs the Bond Commission, is running for the U.S. Senate against Bill Cassidy – do you think he’s interested in being held responsible for the shambles New Orleans’ books have become?

Ditto for Rep. Julie Emerson, who chairs the House Ways and Means Committee and is also running for that Senate seat.

Everybody involved would rather cross their fingers and hope Moreno and Morrell discover some semblance of fiscal continence – because New Orleans is now the crazy uncle in the state’s basement, fiscally speaking, and it’s better if it’s quiet down there because it’s certain good things aren’t going to happen.

Interestingly, Senate President Cameron Henry appears to have been the driving force behind the Commission’s generosity to New Orleans. Henry even hosted a closed-door meeting between state officials and New Orleans councilmembers on November 5th–apparently smoothing over the concerns previously raised by state leaders.

Here is what Henry told WWL Radio about New Orleans:

Henry helped negotiate the city’s case that it did not need a fiscal administrator installed to run the city’s day-to-day affairs. But Henry says there will still be state oversight, particularly from the legislative auditor, as New Orleans pays back the $125 million loan.

“This is a work in progress,” said Henry. “We’re going to continue to work with the city to make sure that they are being responsible with the money, and if they need a little extra oversight, the auditor is more than willing to provide that.”

There are still major problems in New Orleans, though. Even though state tax dollars aren’t directly funding the $125 million loan, we cannot ignore the larger issues:

1. JPMorgan Chase will earn interest off the backs of New Orleans taxpayers. That’s right, one of the world’s largest banks now gets to earn millions in interest off the city’s crisis.

2. The City of New Orleans has no plan to fix its underlying fiscal mess. Instead, city leaders plan to borrow more money from private lenders next year because they want to spread the problem out over multiple years.

3. The Legislative Auditor cannot rewrite the city’s budgets, renegotiate unscrupulous contracts, or fire city managers like a fiscal administrator could. Under the current “oversight” arrangement, the same officials who caused the crisis retain control of the key decisions. Before the administrator would come in, this problem would get worse.

4. The state’s credit rating is now exposed. If New Orleans fails to pay off more than $100 million in loans over the next few years, Louisiana’s credit rating could be dragged down—as bond agencies like Moody’s have warned (see Detroit).

The City of Bogalusa offers a clear parallel. It too was on the verge of missing payroll because of mismanagement and a multi-million-dollar budget deficit for fiscal year 2025. Its Democratic mayor also faces criminal charges–much like outgoing New Orleans Mayor LaToya Cantrell.

But unlike New Orleans, Bogalusa did get a state-appointed fiscal administrator earlier this year.

At the end of the day, the Republicans on the Bond Commission chose short-term political peace with New Orleans politicians over long-term financial stability. The New Orleans City Council had no leverage–yet the Commission folded to the city’s incompetence when it mattered most.

And what’s most problematic here is that without taking control of the city’s finances and putting its rapacious government on a diet, the Bond Commission–clearly taking its cues from Henry–has now put Louisiana’s Republican majority on the hook for the future bad decisions of its Democrat leaders.

This is a case study for that old saying – owe the bank a little money and the bank owns you, but owe the bank a lot of money and you own the bank. New Orleans is now so toxic that it’s easier to sweep its problems under the rug than to fix them.

Lots of cities around the country are like this, but New Orleans is now Louisiana’s very own fiscal toxic dumpsite.

Helena Moreno isn’t a victim of this fiscal mess gracing her inauguration as mayor of New Orleans. She led the City Council as it created all of these problems. Giving her a lifeline without clipping her wings as a result insures that any (frankly unlikely) recovery the city manages will turn her into a hero and fuel her statewide political ambitions. But if and when New Orleans goes deeper into the hole, it will be Henry–dragging along Murrill, Landry and the other Republicans on the Bond Commission–who will be in that hole with her.

What do we get out of all of this? Is New Orleans now going to be a safe, well-run, economically vibrant city? Will the potholes be filled? Will Moreno stop coddling communist protesters as ICE clears illegals out of the city, or will she continue to go on TV to express “concern” over the deportation of criminal illegal aliens?

Maybe there was no choice but to sign off on that loan. But our Republican leaders are going to have to learn to deal much more harshly with messy leftists in the state’s big blue city if we’re going to have the Louisiana renewal we need.

—

Advertisement

Advertisement