(Citizens for a New Louisiana) — The Times-Picayune called the New Orleans bailout approval a “major victory” for Mayor-elect Helena Moreno. But was it, really? The city admitted it can’t meet payroll and agreed to hand its checkbook to the state, all in an effort to avoid the stigma of being placed under fiscal administration — Louisiana’s version of financial custody for insolvent governments. However, what the Louisiana Bond Commission did may actually be more austere. At least, that’s what Governor Jeff Landry said during the most recent Bond Commission Hearing.

If this is winning, one shudders to imagine losing. Anyone can see for themselves that what really happened on November 12 wasn’t a rescue. It wasn’t a New Orleans bailout in any meaningful sense of the word. And it certainly wasn’t a triumph for the same Democratic Party political machine that’s controlled New Orleans since 1870.

No, This Wasn’t a New Orleans Bailout

The $125 million the State Bond Commission approved isn’t new money from the state. It’s what’s called a revenue anticipation note — a loan against New Orleans’ own future tax receipts. It has to be repaid in January, when property taxes are due. In other words, New Orleans borrowed tomorrow’s money because it already spent today’s.

Calling it a New Orleans bailout is like calling a payday loan a pay raise. Like these kinds of financial instruments, the strings are numerous and binding.

The State Got a Financial Veto — Permanently, Not Politely

To get the money, the city had to agree to something no other Louisiana municipality has ever faced — including those that’ve been placed under a fiscal administrator.

- A special fund where every dollar must sit

- No transfers without written approval from Legislative Auditor Mike Waguespack

- Weekly embedded oversight before each payroll run

- Real-time access to all financial systems

- A multi-year forensic audit of city spending from 2022 to 2025

- State authority to freeze money if the city steps out of line

The Times-Picayune mentioned some of this — softly, briefly, and almost apologetically. But the truth is more direct. The Legislative Auditor is now the city’s financial chaperone. Nothing moves without his signature.

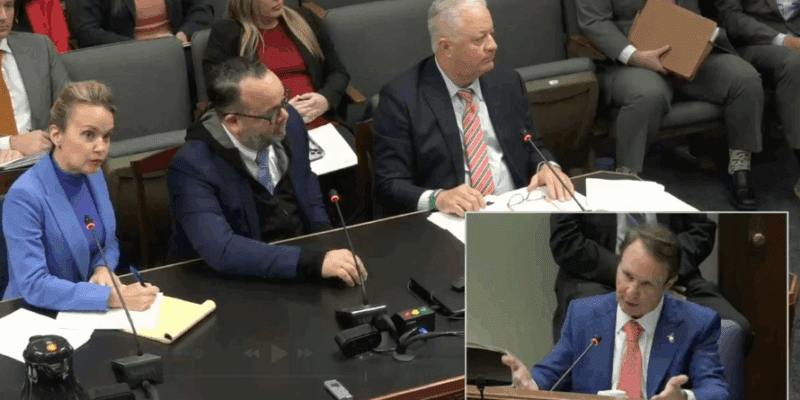

Governor Jeff Landry put it plainly:

“We are treating you differently… more restrictively than anybody else.”

He’s right. No other parish, school board, or city has ever been placed under financial conditions this tight.

The “Takeover” They Avoided

Insiders have been using a particular phrase for weeks: Fiscal Administrator. Simply put, that’s just a state-appointed guardian who takes control of a city’s finances when it becomes insolvent — similar to a court taking custody of a child.

For lawmakers, that term is the nuclear option in the Fiscal Review Committee’s statute. The Times-Picayune whirled past this point briskly, but the stakes couldn’t be clearer. New Orleans avoided fiscal administration only because it accepted conditions that function exactly like it. Senate President Cameron Henry said it openly:

“If this doesn’t work… then that opens the door for us to come in and do things we’re trying not to do.”

And that’s why framing this as a New Orleans bailout misses the entire point. A bailout lifts pressure; this arrangement applies pressure. A bailout offers flexibility; this locks the city into the tightest controls in state history.

Why Does New Orleans Need a Bailout in the First Place

It’s also where the “New Orleans bailout” narrative collapses under its own weight. Here’s the real list, taken directly from sworn testimony:

1. Overtime abuse on a mind-bending scale

- Budgeted: $57,500

- Spent: about $50,000,000

Nope, that’s not a rounding error, and it’s not accidental. When the numbers blow up this big, you can bet it was on purpose.

2. Phantom positions padded the budget

The city budgeted for 1,200 officers, which it hadn’t had in years, and used unspent salary funds to secretly backfill runaway overtime. By the way, if you think New Orleans is the only municipality (or even government agency) that does this, you’re in for a shock. Overestimating payroll and then redirecting those “unused” funds to other priorities is quite common across the state.

3. COVID money created a permanent bureaucracy

Federal dollars funded new staff and programs — and the city never scaled back after the federal money ended. Under the Jindal administration, pundits used to explain it like this: one-time money for recurring expenses.

4. Vendors were told not to submit their bills

Legislative Auditor Mike Waguespack testified that at least one contractor had been instructed by the city to “hold off” submitting a $4.8 million invoice for work already completed. That’s not a budgeting quirk — there wasn’t enough cash to pay them. It also means the city’s true liabilities are higher than what appears on paper because unpaid invoices aren’t reflected in the official budget documents.

As the Auditor put it, the city was prioritizing payroll by delaying payment to vendors. In government accounting, that’s the fiscal equivalent of letting the stack of unpaid bills pile up in a drawer.

5. Spending ballooned

General government spending grew by $112 million since 2019. This wasn’t driven by population growth or higher service demand — New Orleans has fewer residents today than it did in 2019. Much of the increase came from expanding programs during the COVID years and then keeping those positions and costs in place long after the federal money was gone.

In other words, the city allowed temporary spending to become permanent. When the one-time federal dollars disappeared, the recurring expenses didn’t. The result is the structural deficit the state is now trying to unwind.

Helena Moreno’s To-Do List Is Brutal

To her credit, Mayor-elect Helena Moreno didn’t sugarcoat it. She will:

- Require all 660 unclassified employees to reapply for their jobs

- Cut or consolidate departments

- Look at furloughs

- Audit overtime

- Sell unused buildings

- Review contracts and procurement

- Push a charter amendment requiring a balanced budget

Even the Legislative Auditor suggested furloughing employees one day every pay period, saving $25 million per year.

The City Will be Back — Again and Again

The city’s current shortfall isn’t a one-year problem. Waguespack told the Commission he expects New Orleans will have to return for additional emergency loans at least twice more over the next three years while it slowly rebuilds a reserve fund. A healthy city of New Orleans’ size should have roughly $150 million in cash reserves at any given time; right now, it’s not even close.

This will be a multi-year climb out of a deep structural hole, with the state watching every step. That’s the “major victory” the Times-Picayune was referring to. And as the city returns for more emergency borrowing, expect the “New Orleans bailout” conversation to resurface — even though these loans look nothing like a real bailout.

What the Times-Picayune Missed

Here’s the real New Orleans bailout story the statewide paper underplayed:

- New Orleans didn’t get a bailout.

- The city didn’t win anything.

- The state didn’t “rescue” them so much as seize the brakes before the wheels came off.

- The city is now in a supervised financial recovery, indistinguishable from receivership.

- And if the city fails to follow through, the dirty word, “fiscal administration,” is still on the table.

Louisiana’s largest city, and the only major one still under complete Democratic Party control, is now under a level of state oversight more restrictive than anything imposed on any municipality in recent memory.

The public deserves that level of candor from a statewide newspaper. Not a deceptive, softball piece suggesting New Orleans got away with something.

Advertisement

Advertisement