According to a press release from the office of state Insurance Commissioner Tim Temple, at least with respect to auto insurance, the answer is yes.

At least, in some cases.

Temple Highlights Recent Auto Insurance Decreases Driven by a Reduction in Accident Frequency

Commissioner Tim Temple is providing an update on trends in Louisiana’s auto insurance market through mid-2025, including several auto insurance rate decreases that are primarily driven by reductions in accident frequency.

“As cost drivers in the market go down, losses go down with them, and businesses are incentivized to compete for customers through lower pricing,” Commissioner Temple said. “While it will take time for this year’s legal reforms to take effect and begin making a difference, it is a positive sign that insurers saw fewer accidents in 2024 and early 2025.”

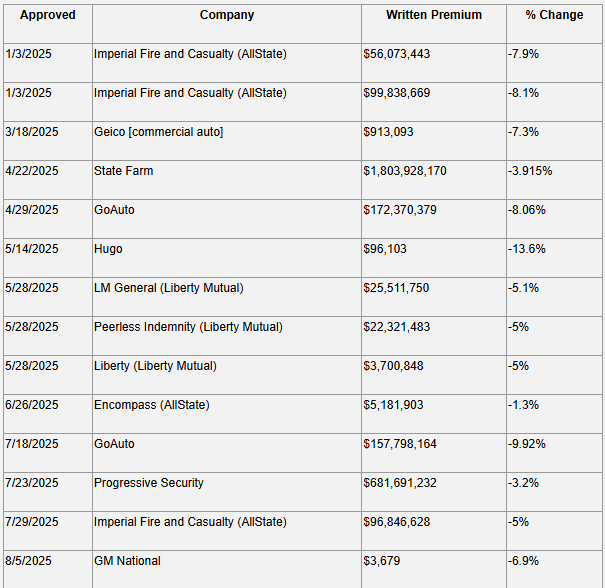

Since Jan. 1, 2025, auto insurers have filed over 20 rate decreases in the Louisiana market. Of those, 14 were for a decrease of more than 1% (13 private passenger auto filings and one commercial auto filing). The insurers generally cited reductions in accident frequency as the primary reason for the decreases. The decreases are as follows:

There’s a chart…

But the press release goes on to give some additional detail…

In this year’s session, Commissioner Temple collaborated with legislators to develop and pass legal reform aimed at strengthening the auto insurance market by reducing excessive lawsuits and inflated bodily injury claims, all while continuing to focus on improving the property insurance market.

“Our focus on improving our regulatory and legal environments while ensuring rates are actuarially justified will promote competition and ultimately stabilize auto insurance premiums for Louisiana drivers,” Commissioner Temple said. “As we’ve just seen in Florida, where the top five auto insurers have filed for rate decreases in 2025 after beginning to focus on reform in 2022, it can take a year or two of consistent reform to drive down rates.”

Private Passenger Auto Market Trends

In Louisiana’s private passenger auto market, the statewide average market impact for approved rate changes for 2024 was +2.2%. This is a sharp decrease compared to 2023, which was +15.3%, and 2022, which was +10.8%. Through July 2025, the average market impact is a rate decrease of 2.3%.

Since 2022, the number of requested rate increases in the private passenger auto market is trending down, while the number of requested decreases is trending up. In 2022, there were 70 requests for increases and three for decreases. In 2023, there were 76 requests for increases and two for decreases. In 2024, there was a significant reduction in the number of requests for increases with 49, and an uptick in the number of requests for decreases with nine. Through July 2025, there were 13 requests for increases and 19 for decreases.

Commercial Auto Market Trends

In the commercial auto market, the statewide average market impact for approved rate changes for 2024 was +8.5%. This is an increase compared to 2023, which was +6.9%, and 2022, which was +4.1%. Through July 2025, the average market impact is a rate increase of 4.9%.

Since 2022, the number of requested rate increases in the commercial auto market is trending up, while the number of requested decreases has remained steady. In 2022, there were 73 requests for increases and three for decreases. In 2023, there were 85 requests for increases and two for decreases. In 2024, there were 95 requests for increases and four for decreases. Through July 2025, there were 63 requests for increases and one for a decrease.

So while we’re seeing some insurers file for rate decreases, which is definitely a good sign and indicative that there could be some downward price competition in a healing insurance market, what Temple isn’t claiming is that auto insurance is coming down on the whole. The trend is downward but it isn’t negative yet. Maybe we’ll get that next year.

And we’re definitely not moving forward in the commercial market, which means insurance is still a hindrance to economic and job growth in the state.

You’ll notice that there’s zero mention of Gov. Jeff Landry, who signed all of the bills which look to have contributed to the good news we do have in the insurance market. It doesn’t appear that Landry and Temple have buried the hatchet much from the feud between the two that blew up during the legislative session.

Still, there is some good news here. When insurers are dropping rates, even if it’s only some of them, it tells you that the market is stabilizing.

State Sen. Valarie Hodges took the news with a healthy dose of joy…

AUTO INSURANCE RATES DROPPING!

Auto insurance rates are finally heading DOWN — thanks to reforms passed by your Legislature, championed by Commissioner Tim Temple, and signed into law by Governor Jeff Landry.

Since Jan. 1: 20+ insurers cut rates — some by double digits!… pic.twitter.com/D8owv7HKUE

— Valarie Hodges (@ValarieHHodges) August 15, 2025

Advertisement

Advertisement