Yesterday was the 111th anniversary of the gusher at Spindletop which ushered in the modern American oil and gas industry…

On this day in 1901, a drilling derrick at Spindletop Hill near Beaumont, Texas, produces an enormous gusher of crude oil, coating the landscape for hundreds of feet and signaling the advent of the American oil industry. The geyser was discovered at a depth of over 1,000 feet, flowed at an initial rate of approximately 100,000 barrels a day and took nine days to cap. Following the discovery, petroleum, which until that time had been used in the U.S. primarily as a lubricant and in kerosene for lamps, would become the main fuel source for new inventions such as cars and airplanes; coal-powered forms of transportation including ships and trains would also convert to the liquid fuel.

Crude oil, which became the world’s first trillion-dollar industry, is a natural mix of hundreds of different hydrocarbon compounds trapped in underground rock. The hydrocarbons were formed millions of years ago when tiny aquatic plants and animals died and settled on the bottoms of ancient waterways, creating a thick layer of organic material. Sediment later covered this material, putting heat and pressure on it and transforming it into the petroleum that comes out of the ground today.

In the early 1890s, Texas businessman and amateur geologist Patillo Higgins became convinced there was a large pool of oil under a salt-dome formation south of Beaumont. He and several partners established the Gladys City Oil, Gas and Manufacturing Company and made several unsuccessful drilling attempts before Higgins left the company. In 1899, Higgins leased a tract of land at Spindletop to mining engineer Anthony Lucas. The Lucas gusher blew on January 10, 1901, and ushered in the liquid fuel age. Unfortunately for Higgins, he’d lost his ownership stake by that point.

Beaumont became a “black gold” boomtown, its population tripling in three months. The town filled up with oil workers, investors, merchants and con men (leading some people to dub it “Swindletop”). Within a year, there were more than 285 actives wells at Spindletop and an estimated 500 oil and land companies operating in the area, including some that are major players today: Humble (now Exxon), the Texas Company (Texaco) and Magnolia Petroleum Company (Mobil).

Spindletop experienced a second boom starting in the mid-1920s when more oil was discovered at deeper depths. In the 1950s, Spindletop was mined for sulphur. Today, only a few oil wells still operate in the area.

Spindletop was a long, long time ago. Also yesterday, the Institute for Energy Research came out with a report detailing exactly how far we’ve come since the heady days of Lucas’ strike. Rather than oil, we’re a nation running on hot air instead…

The interior department announced Tuesday that oil and gas lease sales on public lands increased 20 percent in 2011, generating more than $250 million in profits for taxpayers. The fact, however, is that oil production on federal lands, lease sales, and revenue have drastically declined during the Obama administration.

“The American people need only to check their electric bills or the price they are paying at the pump to see just how well the Obama administration’s energy policies are working. Today’s announcement by the interior department that lease sales are increasing is misleading and disingenuous. The president promised to make energy prices “skyrocket,” and so he has. The American people deserve the facts about this administration’s anti-energy agenda, not more propaganda from Ken Salazar,” said IER Senior Vice President Dan Kish.

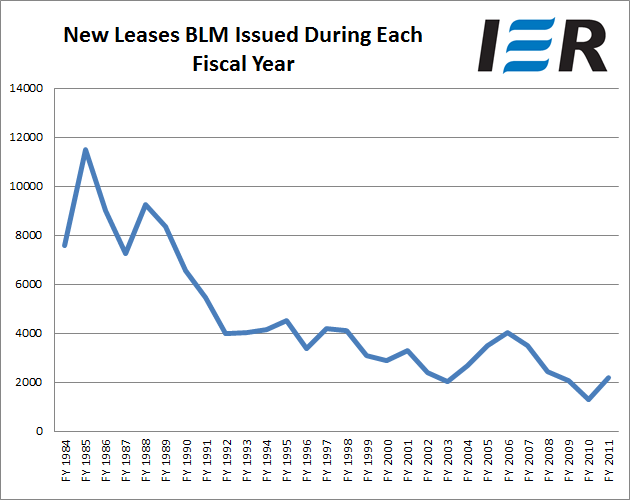

The lies are blatant. For starters, the White House claims that oil leases on federal lands went up 20 percent last year. That’s nominally true, but it’s a laughable statement none the less. If your score drops from, say, 100 down to 10 and then you increase it to 20 you can say you’ve doubled your score – but you’re still a disaster.

And that’s a good way to describe what the Obama administration has done to the federal mineral lease program…

Yes, it’s fair to note that every president since Reagan has been a disaster when it comes to utilizing federal lands to promote domestic energy production. And after a four-year bump during his term, George W. Bush oversaw a precipitous decline as well – so he’s not blameless either.

But Obama tanked the lease program like no other president in American history. Now he wants to take credit for taking his foot off the brake after his offshore moratorium became a political football.

There’s more. Obama is bragging about bringing in $250 million in lease sales, a figure he says is up 20 percent from last year. But guess what’s down from last year – oil production on federal lands. In 2010 it was 112 million barrels; last year less than 98 million. That’s a 13 percent drop.

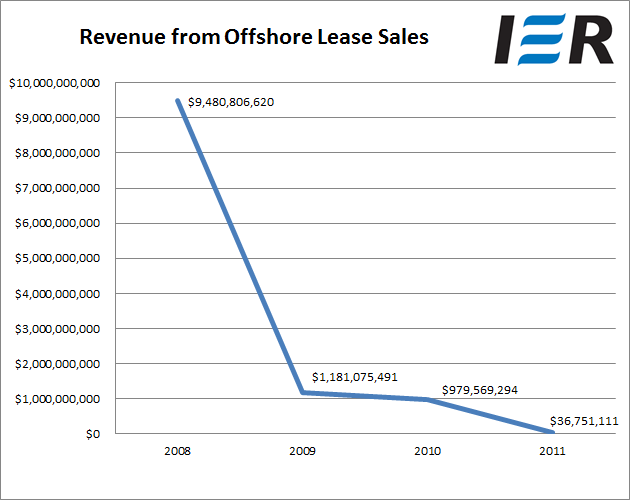

And then there’s this graph showing what’s going on offshore over the last four years.

That’s more than $9 billion in lost revenue per year thanks to a diminution of drilling leases offshore since Obama took office. Don’t issue leases, and you’re unlikely to see much long-range growth in production or revenue from royalties, are you?

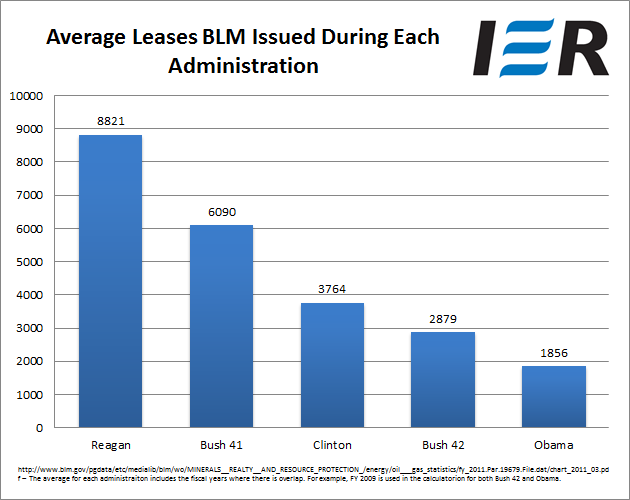

And then we have this, in response to a claim the administration is making about how it’s opening up more land for oil and gas exploration…

One could make the argument that since the federal government has a finite amount of land available to issue leases on, it’s a matter of time before you’ll start to see numbers like these come down.

Except when you’ve put all of the Atlantic and Pacific coasts, plus the Eastern Gulf, off limits to drilling, which we’ve done since the Carter administration if not before, it makes that reckoning come considerably sooner.

But that’s not what’s going on here. The Obama administration isn’t issuing leases, period. It went an entire year without a lease sale for the Gulf; that was unprecedented since the industry began drilling there. Little surprise those numbers are so puny.

Meanwhile, it’s January – which isn’t exactly peak driving season – and we’ve still got $100 oil.

Given that, you’d expect a full-scale program aimed at getting oil from federal lands and offshore seabeds – not just to boost the economy but to get the revenue from lease sales and royalties into an empty federal treasury.

But that would be what you’d do if you actually wanted to improve the condition of the American people instead of living out a left-wing ideological fantasy on the taxpayers’ dime.

Advertisement

Advertisement