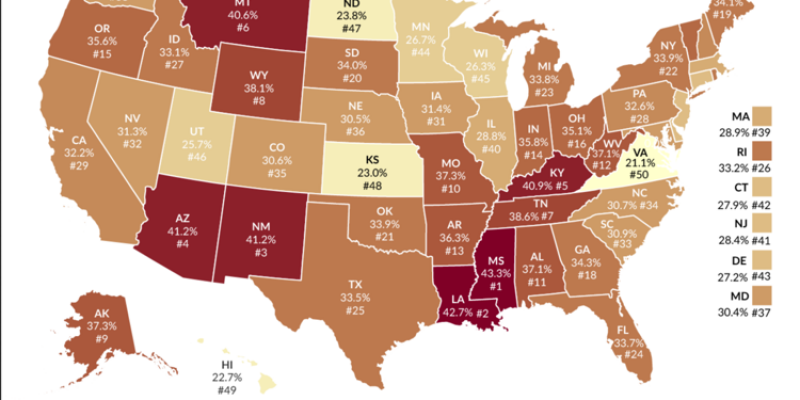

Louisiana finished second in a study by the Tax Foundation examining which states rely most on federal aid funding as a percentage of their general-fund revenue.

Federal funding makes up 42.7 percent of Louisiana’s general revenues, including all tax revenues and excluding investment income from state retirement funds or revenue received for providing utility services, according to the analysis.

Aid provided to states can come in the form of competitive federal grants, or federal funds can be allocated based on formulas established by statute, the Tax Foundation study says. States that receive a greater share of federal funds tend to have more low-income residents and below-average lower tax collections, according to the foundation.

The states most dependent on federal funds were Mississippi, Louisiana and New Mexico. The study used the most recent available data from fiscal-year 2016.

—

Which States Are Most Dependent on Federal Aid?

| State | % of Federal Aid | Ranking (Most to Least |

| Mississippi | 43.3% | 1 |

| Louisiana | 42.7% | 2 |

| New Mexico | 41.2% | 3 |

| Arizona | 41.2% | 4 |

| Kentucky | 40.9% | 5 |

| Montana | 40.6% | 6 |

| Tennessee | 38.6% | 7 |

| Wyoming | 38.1% | 8 |

| Alaska | 37.3% | 9 |

| Missouri | 37.3% | 10 |

| Alabama | 37.1% | 11 |

| West Virginia | 37.1% | 12 |

| Arkansas | 36.3% | 13 |

| Indiana | 35.8% | 14 |

| Oregon | 35.6% | 15 |

| Ohio | 35.1% | 16 |

| Vermont | 34.9% | 17 |

| Georgia | 34.3% | 18 |

| Maine | 34.1% | 19 |

| South Dakota | 34.0% | 20 |

| Oklahoma | 33.9% | 21 |

| New York | 33.9% | 22 |

| Michigan | 33.8% | 23 |

| Florida | 33.7% | 24 |

| Texas | 33.5% | 25 |

| Rhode Island | 33.2% | 26 |

| Idaho | 33.1% | 27 |

| Pennsylvania | 32.6% | 28 |

| California | 32.2% | 29 |

| New Hampshire | 31.9% | 30 |

| Iowa | 31.4% | 31 |

| Nevada | 31.3% | 32 |

| South Carolina | 30.9% | 33 |

| North Carolina | 30.7% | 34 |

| Colorado | 30.6% | 35 |

| Nebraska | 30.5% | 36 |

| Maryland | 30.4% | 37 |

| Washington | 30.2% | 38 |

| Massachusetts | 28.9% | 39 |

| Illinois | 28.8% | 40 |

| New Jersey | 28.4% | 41 |

| Connecticut | 27.9% | 42 |

| Delaware | 27.2% | 43 |

| Minnesota | 26.7% | 44 |

| Wisconsin | 26.3% | 45 |

| Utah | 25.7% | 46 |

| North Dakota | 23.8% | 47 |

| Kansas | 23.0% | 48 |

| Hawaii | 22.7% | 49 |

| Virginia | 21.1% | 50 |

Source: Tax Foundation; U.S. Census Bureau

This is a revision of an article first published on Watchdog.org.

Advertisement

Advertisement