On the opening day of Hurricane Season, I filed a lawsuit against the federal government over Risk Rating 2.0 — the new flood insurance rates that are driving our neighbors into foreclosure and bankruptcy. On Friday, my legal fight to protect Louisiana homeowners and businesses made its way to the U.S. District Court in New Orleans; and what Biden bureaucrats defending these unlawful metrics had to say was astounding.

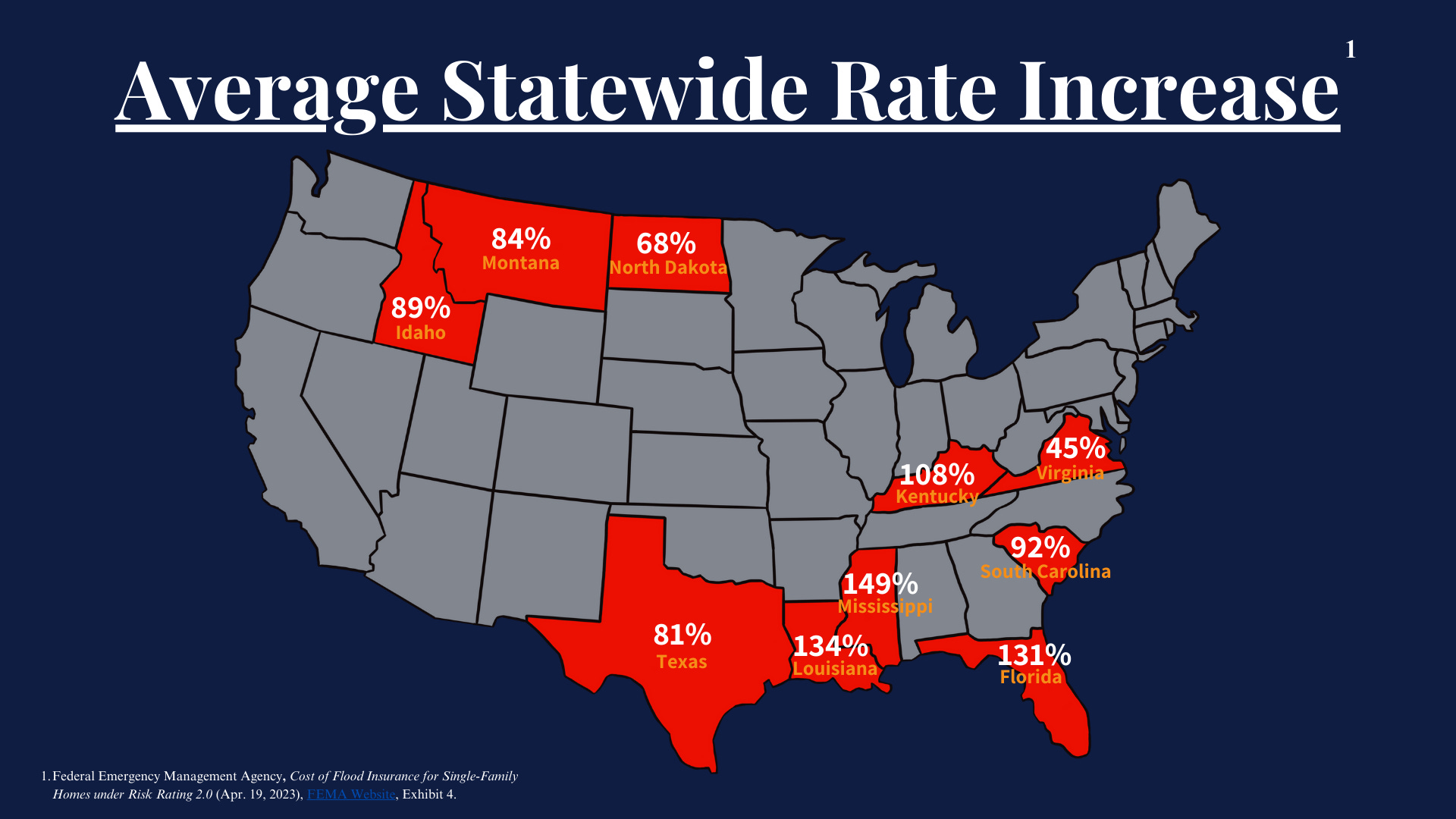

FEMA’s lawyers argued that the majority of NFIP customers have seen their rates decrease or only modestly increase since the inception of this program. But only a Common Core math student would conclude that a 134% – the average statewide rate increase in Louisiana – is “modest.”

Even then, Cameron Parish has seen a rate increase of 229%, Terrebonne Parish 305%, Lafourche Parish 321%, and Plaquemines Parish a whopping 545%. These are not modest by any stretch of the word, and precisely why my office is suing FEMA. We are fighting back to ensure that the people of Louisiana are able to stay in our great State – not sell their homes, close their businesses, and migrate away from their families because of government policies that lack transparency and common sense.

In court, my office highlighted how these mysterious increases based on a secret algorithm and secret math are damaging our communities, lowering property values, and driving people out of their Parishes if not the entire State. FEMA’s attorneys countered that, if true, we should simply raise taxes to recoup losses – anything to protect their entirely new methodology built from the ground up to address “climate change.”

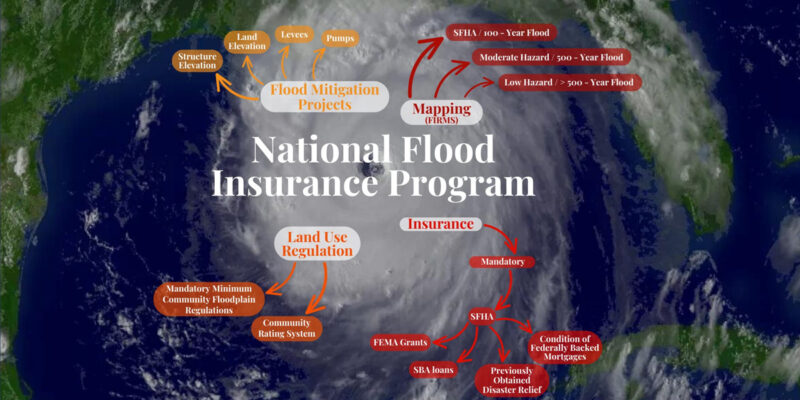

This new system no longer takes into account the mitigation measures your tax dollars pay for, such as sprawling levee and drainage systems. It also fails to honor the grandfathering of rates, which have been extremely valuable for families living along our Gulf Coast. In 1968, Congress made it clear that NFIP rates must be reasonable and transparent. Instead, they have become unaffordable and opaque, with new “actuarial principles” being protected as if they were “trade secrets.” As my Solicitor General Liz Murrill stated: this flood program has turned into Hotel California: you can check in any time you like; but once in, you can never leave.

In other words, if you are non-compliant with FEMA’s requirements, and do not possess adequate flood insurance through the NFIP program, you will no longer have access to FEMA programs in the aftermath of a natural disaster. Emergency services would still be available, but parishes that do not play ball will not receive any recovery relief or federal assistance when the time comes to rebuild. While FEMA has been a very valuable partner with our State in recovering from hurricanes and floods, we cannot allow the parishes or the people of those parishes to be held hostage by sharp premium increases tied to their mortgages. As Saint Charles Parish President Matt Jewell testified on the stand, “it’s about as voluntary as paying taxes.”

Advertisement

And while FEMA lawyers downplayed the effects these increases will have on our communities, Lafouche Parish Assessor Wendy Thibodeaux highlighted for the court how these changes affect their tax base, the oil & gas industry, our port system, and overall market values. If our people cannot afford these rates, they will either be forced to sell their home at a significant loss or abandon the property entirely, causing a financial crisis as the banks struggle to manage mass foreclosures. Abandoned properties would also attract crime, squatters, and drug users, with a lack of funding equating to a lack of police – further contributing to existing problems plaguing our State.

As a result, Risk Rating 2.0 is causing irreparable harm that absolutely undermines the considerable investments we’ve made. We simply cannot raise taxes to make up for these losses, as FEMA’s attorneys suggested. That would further exacerbate our migration problems, causing a mass exodus from the State alongside a loss of our cultural heritage and the destruction of our real estate markets, communities, and critical waterfront industries.

Solicitor General Murrill closed last week’s hearing with a declaration that Risk Rating 2.0 is a hurricane of its own – far slower but still tearing our communities apart. I agree completely, which is why we have asked the courts for injunctive relief that will stop the raising of rates and protect those with grandfathered-in rates across Louisiana.

We have an affordability crisis in our State – with families choosing between groceries, electricity, and insurance. FEMA claims their flood insurance rates are meant to mitigate risk and prevent harm. But Judge Darrel J. Papillion wisely retorted: “is homelessness an irreparable harm?”

In California, they might say no; but here, we are fighting back.

Advertisement

Advertisement