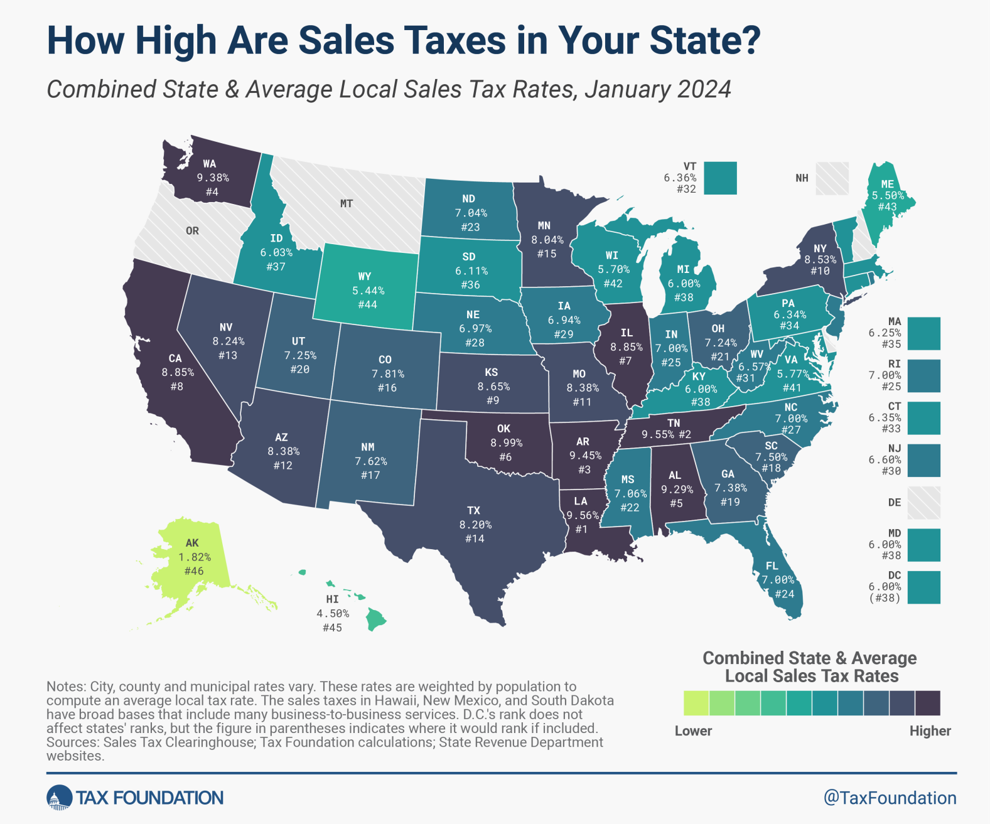

(By Steve Wilson/The Center Square) – According to data from a national tax policy group, Louisiana’s combined sales tax rate is the nation’s highest.

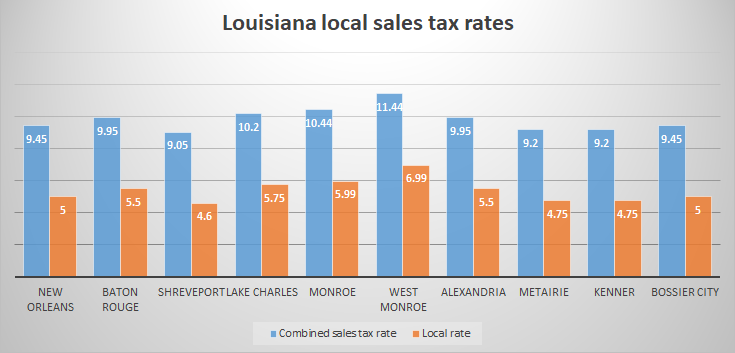

The Washington, D.C.-based Tax Foundation ranked Louisiana as the highest combined state/local sales tax rate at 9.56%. The state sales tax is 4.45%, with the highest local option tax in West Monroe in northern Louisiana with a combined rate of 11.44%. The Pelican State is one of 38 states that allows local sales taxes.

According to the most recent data, sales and use tax revenues (the Louisiana Department of Revenue counts them together) amounted to 34.7% of the state’s nearly $13 billion in tax receipts in fiscal 2023.

The Pelican State has higher sales taxes than its neighboring states. Arkansas was third highest with a combined rate of 9.45%. Next were Texas (8.2%, 14th) and Mississippi (7.06% for 22nd).

For combined rates among Louisiana’s largest cities and communities, Monroe was second at 10.44%, followed by Lake Charles (10.2%); East Baton Rouge and Alexandria (9.95%); New Orleans and Bossier City (9.45%); and Jefferson Parish (9.2%). Shreveport had the lowest rate of the state’s largest cities at 9.05%.

Advertisement

The state’s sales tax rate will drop by 0.45% next year, but the state faces a financial cliff in coming years as several temporary measures such as the sales tax increase will sunset while some sales tax exemptions will go back into force. The state is projected to be short $558 million in the next budget cycle, $614.1 million the year after that and $733.4 million in the year following.

The state has more than 200 exemptions for sale taxes. Louisiana treasurer John Fleming recommended that a special session be called for tax reform that could include reducing the state’s sales tax rate and eliminating the regressive corporate franchise tax among other proposals.

Nationally, Tennessee was second highest with a combined sales tax rate of 9.55%. Washington (9.38%) and Alabama (9.29%) were next. The Tax Foundation says sales taxes are responsible for 32% of state tax receipts and 13% of local tax collections, adding up to 24% of combined revenue.

Advertisement

Advertisement