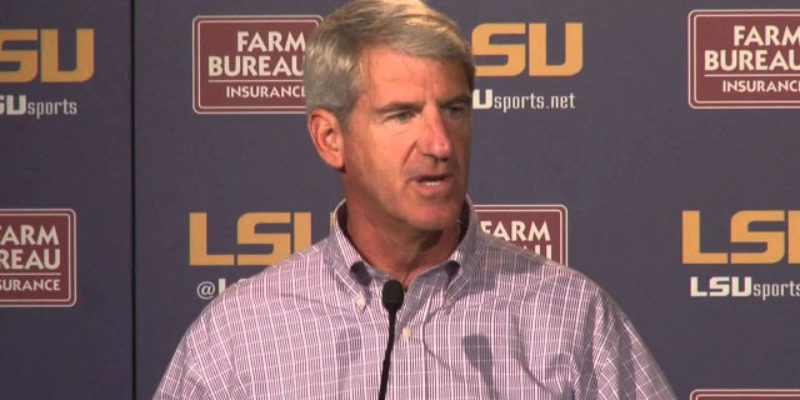

You may have missed this yesterday, but the Baton Rouge Business Report had a story about how LSU’s athletic director Joe Alleva is in a panic over the tax reform bill introduced in the House…

LSU officials are worried the proposed House GOP tax reform bill would be “disastrous” for college athletics, with one key provision that would hit a more than $50 million-per-year revenue stream at the university.

At issue in the Tax Cuts and Jobs Act is one obscure but significant clause that gets rid of a tax break for people who donate to colleges in exchange for seating rights.

LSU, like many other schools throughout the country, requires a donation for people to obtain most season tickets. Currently, people who make those donations can write off 80% of the gift on their taxes, something LSU officials say is a vital incentive for fans.

“It’s impossible to tell how people would react but potentially it really could be disastrous to intercollegiate athletics in the form we know it now,” LSU Athletic Director Joe Alleva says. “I don’t have any way of making that money up.”

LSU athletics, largely on the coattails of the powerhouse football program, has been able to remain insulated from controversy surrounding cuts to higher education in recent years, mainly because it is profitable. In fact, university officials often point out that LSU athletics gave nearly $50 million to academics over the past five years.

The article goes on to note that if you cut taxes on “the rich,” which doesn’t appear to be a particular aim of the tax reform bill other than its attempts to cut the corporate tax rate (a subject upon which we’ll differ with leftist LSU tax law professor Philip Hackney who’s quoted in the piece), then the current allowance for a writeoff of seat licenses in Tiger Stadium isn’t as valuable.

We have three thoughts on this.

First of all, whatever cost to LSU were Congress to eliminate the deduction for seat licenses would likely be a lot less than anybody over there thinks. Does such a change help LSU or college athletics? Of course not. But the vast majority of the people cutting that check to the Tiger Athletic Foundation aren’t doing it in order to get a tax writeoff – they’re doing it so they can get good seats to watch LSU play football, or basketball, or baseball. That TAF sends along a tax letter every January you can give to your accountant is a nice bonus, but there really aren’t all that many people who depend on that writeoff to such an extent that they wouldn’t pay for those tickets otherwise. The guess here is that out of the $50-60 million LSU pulls from seat licenses every year, they might be out a million bucks or two as a result of this change.

And maybe not even that, since the people who would abandon their tickets because the tax writeoff for the mandatory donation they carry went away are not The Rich. Your author has two football season tickets I’m paying about a grand a year for in TAF donations, and I am most definitely not The Rich. If I were to get rid of those tickets I’d be doing so off a pure cost-benefit analysis, and likely because I had a line on better seats I could get from somebody else. But the middle class, cost-conscious penny-pinchers who would be abandoning TAF in droves according to Alleva are the very ones who’d be getting a tax cut under this tax reform plan – and given the emotional tie and cultural primacy of LSU football to the folks who hold those season tickets, it’s a pretty good bet they’d reinvest those tax savings into keeping their seats.

That’s Thought #1. Thought #2 is that if Joe Alleva wants to get into the politics of federal tax law, then he should see if he can make the case for why we ought to be borrowing money from China in order to subsidize higher ticket prices in college football stadia. And good luck with that.

Your author is as big a college sports fan as there is, but come on. There is no public policy imperative that is served by pumping federal tax expenditures into big-time college sports in this way. Seat licenses are a way for schools like LSU to price their season tickets at market value and to drive a maximum of revenue associated with the better seats without alienating current customers – a true market-oriented approach would be a seat auction every year in which prospective season ticket holders would bid on seats and be assigned tickets based on those bids, but it’s unlikely too many college or pro teams could get away with so little loyalty to their long-time fans. But that’s a practice which makes economic sense with or without the added boost of a tax writeoff.

And while there is a trickle-down effect that those seat licenses might help drive a bottom line for college athletics which helps the universities sponsoring them – which is certainly true at LSU since the athletic department kicks a chunk of its profit up to the academic side – that’s not true in every case. What that tax writeoff is fueling, to the extent it makes a real difference in the amount of revenue those universities derive (as we explained above, that’s a bit of a dubious proposition), is the facilities arms race in college athletics which everybody understands is out of control.

LSU has expanded Tiger Stadium from 80,000 seats to 102,000 in the past 20 years while greatly increasing ticket prices. The population of Baton Rouge is pretty stable over that time, and the population of Louisiana is almost completely stagnant. Are there more LSU fans than there used to be? Perhaps. Are there more people interested in buying season tickets than before? Perhaps slightly, though a lot of people will tell you the growth in the fan base would have come in the time between when the stadium expanded from 80,000 to 92,000, or shortly after, and it’s probably somewhat stagnant since.

But in that time, when there has been relatively meager growth in the fan base LSU has watched its revenues explode to the point that every program in the athletic department has received a major facilities upgrade. The last one was the tennis program, which recently completed a magnificent new stadium and practice facility across the street from the new Alex Box Stadium. If you haven’t been on LSU’s campus in the past 10 years you probably wouldn’t even recognize the place, it’s dripping with so many trappings of wealth.

That’s not a complaint. But it is a recognition that LSU’s athletic program is in a bubble. This kind of extravagance isn’t going to last; market forces are going to trim it back eventually. And those forces will trim back LSU’s competition just the same, so the all-important competitive aspect of these sports probably won’t suffer as much as Alleva and others make out. If they’re a smaller part of a bigger national economy, well, that’s OK.

Advertisement

Thought #3 is that Alleva’s statement that he can’t make up what money is lost if the tax reform bill kills the seat license writeoff is a load of bovine excrement.

First of all, does anybody really think they’re running a tight ship in that athletic department? The salaries up there are off the charts. Alleva himself makes $800,000 per year, which is ridiculous. University president F. King Alexander irritated a lot of people with his dumb quote about paying a million dollars for a “punting coach,” but there is some truth to that complaint in that LSU’s spending the better part of $4 million per year on Matt Canada and Dave Aranda as the offensive and defensive coordinators, respectively. They’re both excellent, and nobody is advocating for making them take a pay cut, but when each inevitably moves on it would be hard to justify paying their successors the kind of money they make. A million bucks should get you a plenty good enough offensive or defensive coordinator. Not to mention LSU is paying a million bucks a year to Nikki Fargas as the women’s basketball coach and it’s questionable whether she’s worth even half that.

If the athletic budget needs to be shaved by a million bucks or two, that can certainly be done without ending up in last place.

But if not, here’s an idea Alleva ought to consider: you’ve probably heard all the complaints about how the fans are leaving games early, and how Tiger Stadium looks empty in the second half. There are lots of reasons for that, most prominently that traffic coming out of that stadium is murderously bad and dealing with it is becoming too much to handle for lots of people. If LSU isn’t willing to work with the state and the city to find a way to alleviate those problems, the way to keep the stadium full as the fans file out is to sell discounted general admission tickets at halftime for, say, $15 for the non-conference rent-a-win games and $25 for SEC games. The regular fans might be heading home to beat the traffic, but the blue-collar people who supposedly have been priced out of the stadium and thus its atmosphere has been ruined can ride in to shore up the crowd noise.

Truth is, those folks can already get tickets for $25 or less most of the time – because the stadium is now a little bigger than the fan base can support and you don’t get truly hard sellouts anymore because LSU is a Top 25 program right now but not a Top 5 program (if it was a Top 5 program there would really be no discussion of how the fans need tax writeoffs to pay for season tickets). But this would be a way for LSU to get those dollars rather than have ticket scalpers outside the stadium or random people on Craigslist getting them.

Either way, Alleva would do well not to advocate about tax policy. Not when he’s built a reputation for soaking the fans and embarrassing LSU with stupid statements in the first place. To continue hamstringing the American economy with a dysfunctional tax code so as not to disrupt the college sports bubble is not a defensible position to advocate for.

Advertisement

Advertisement