He says “everybody needs some skin in the game…”

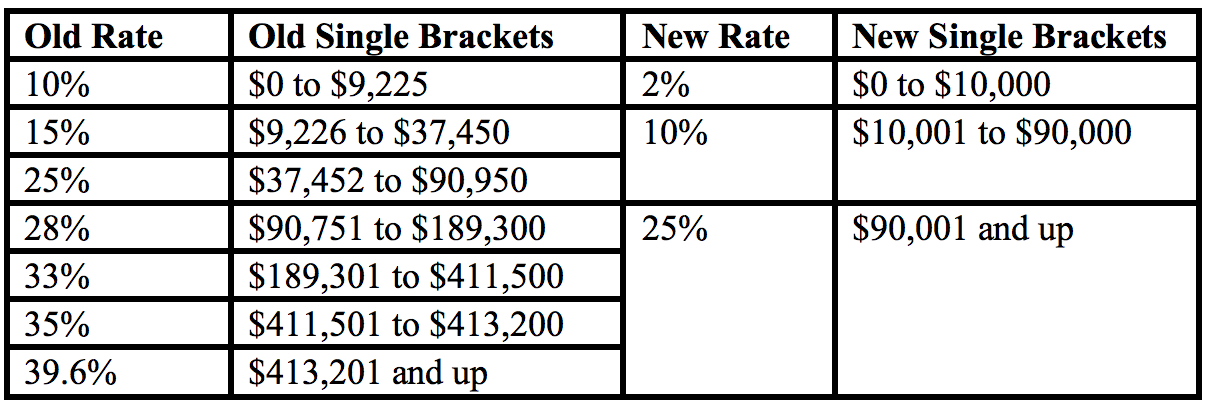

My tax plan lowers the tax bracket for every American, and it dramatically simplifies the tax code for every American. To grow the American economy we must reduce our tax burden and make taxes simpler. My plan has only three rates – 2 percent, 10 percent, and 25 percent. Most Americans will be in the 10 percent bracket.

Most Republican plans brag about the idea that they will allow about half of all Americans to pay zero federal taxes. I think that is a terrible mistake. Again, most Republican plans do not require the lowest wage earners to pay anything, and some basically require half of Americans to pay zero federal taxes.

We have come to the point in this country where far too many Americans believe that money grows on trees in Washington. They do not seem to get the fact that our government has no money other than what it takes from our citizens. President Obama has nearly doubled our national debt.

We simply must require that every American has some skin in this game. If we have generations of Americans who never pay any taxes, it will be very easy for them to turn a blind eye to absurd government spending and to continue to allow our government to bankrupt our nation.

There is great strength in shared sacrifice. My plan only asks 2 percent from the bottom bracket but that may be the most important 2 percent in the whole plan. It reestablishes the idea that in America everyone is expected to help row the boat. Now some people may have a bigger oar and some smaller but you keep your oar in the water along with everyone else.

The liberal Democrats will hate this plan, and they will claim that it is not ‘fair.’ Remember this about socialism – it is fair. In socialist economies, everyone is poor, and therefore all but the ruling class suffer equally.

The genius of America is that hard work and ingenuity are rewarded and enable people to succeed and make their own way in life. Independence, not dependence, is the root of the American Dream. It’s time we had the guts to say so in public. There is dignity in work. Work should be embraced not avoided. Earned success increases personal happiness in a way that unearned success does not, and never will.

Among the highlights in this plan:

1. It eliminates the corporate income tax, which is a great idea. Corporate income taxes are stupid; those taxes aren’t actually paid by corporations, they’re passed on to the consumer in higher prices and the workers in lower wages. By eliminating corporate income taxes, you’re creating a pool of capital which is going to be spent a number of ways which grow the economy; either by paying dividends to stockholders, which will increase the worth of everybody’s 401(k) plan, by giving the workers a raise, which is absolutely something this country needs in a period of stagnant or declining wages and a lower standard of living, or by lowering prices which would aid in reducing the cost of living for the consumer.

Don’t discount the third possibility. All we hear is how a minimum wage increase is such an imperative; well, if there were price wars going on in industry after industry that would work just as well as a minimum wage increase to give poor people a break, and it would do so without the unintended consequences of barring entry into the workforce for those with skills not marketable enough to command more than $7.something an hour.

2. It keeps only five tax deductions: charitable donations, the Earned Income Tax Credit, which it applies to the payroll tax instead of income taxes, mortgage interest, but it drops the ceiling on that from $1 million to $500,000, health insurance goes from an exclusion for employer-provided plans to a standard deduction for health insurance costs, and a nonrefundable dependents credit that accounts for household size of dependents: children under the age of 18, elderly making less than $5,000 over the age of 65, and the disabled.

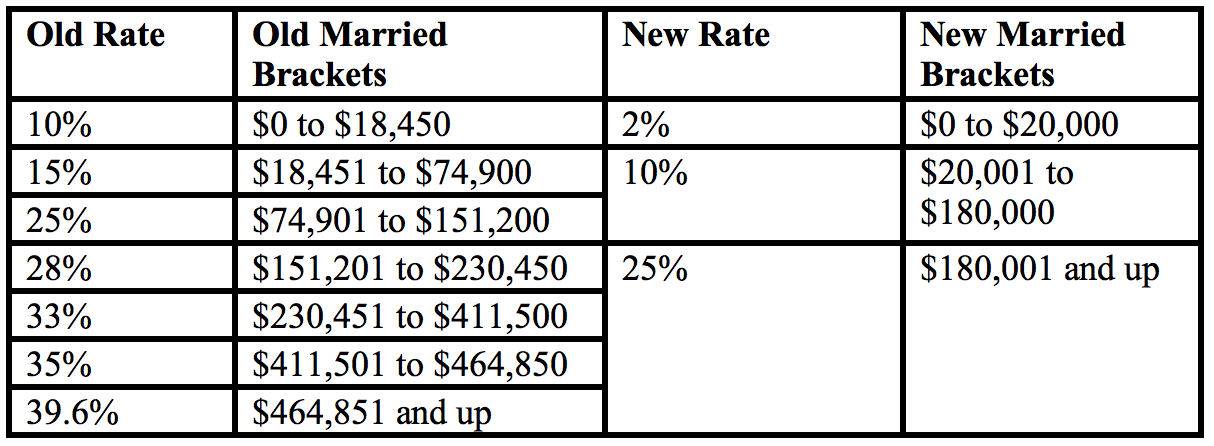

3. Since it allows for two ways to file only, married or single, it addresses the marriage penalty by doubling income brackets for married vs. individual filers and allowing married filers to choose how to file. By doubling the tax brackets for married couples, you no longer have the problem of that second income bumping the household into another tax bracket and creating perverse incentives.

4. His tax brackets…

Ideally, we should go to a flat tax with an exemption that doesn’t kick in at the first dollar earned, like for example a 20 percent flat tax that kicks in at the first $5,000 in income (everybody pays at least $1000 a year) but offers an exemption for the next $25,000 for single people and $10,000 for each additional member of the household.

Short of that, this isn’t bad. It attacks the question of making sure even poor people vote like taxpayers, and it has a small number of reasonable tax rates.

5. It allows for a tax-free savings account that people could pump up to $30,000 per year into. By doing that you’re introducing some elements of Fair Tax/consumption tax thinking into the mix, because you’re incentivizing savings rather than spending within your financial management decision-making. And it provides for a transition into the new account by allowing existing retirement and tax-free savings accounts, such as those for college, to be grandfathered in or they could be rolled over into the new TFSA. Any contributions to these accounts would be subtracted from the $30,000 cap and unused contribution value could be rolled into future years. Roth accounts would remain separate from the TFSA completely in order to avoid double taxation.

6. It taxes capital gains as income, so you no longer have to listen to this dopey narrative about how Warren Buffet’s secretary pays more in taxes than he does. That isn’t a particular pro-growth feature, though, because that means you’ve got an effective 25 percent capital gains tax rate. Which is an increase from what you have now, but on the other hand it’s a lot simpler for everybody to just forget about the difference between capital gains and income and just report what they made.

7. It offers a one-time 8 percent tax rate on capital stashed abroad, which if that figure is $2 trillion should bring in an immediate $160 billion in revenue to the government and $1.84 trillion in private-sector economic stimulus to the country. This is a fairly standard proposal among the GOP candidates, though there are different rates offered in some of these plans. That’s obvious policy, which is why Obama won’t have it.

8. It wipes out inheritance and gift taxes.

This thing anticipates a $9 trillion tax cut over the next 10 years, but it expects to generate about 1.4 percent economic growth per year during that time on top of the standard 2 percent growth expectation. It expects to create 5.9 million new jobs over that time, with 8.7 percent wage growth.

Who knows if those numbers will hold up. But all in all this is a very solid tax plan – it spreads the tax burden out over the population and puts a lot of people into the realm of taxpayers who aren’t, currently, and that’s a good idea, while making things a lot simpler and allowing for some further reforms.

You put this plan in place and you can get rid of Obamacare (Jindal’s tax plan actually gets rid of all the Obamacare taxes), because you’re creating a deduction for health insurance available to everybody and that lays a foundation to make it easier for people to get covered. That also allows for a transition of Medicare into something of a premium-support program rather than single-payer; between the health insurance deduction and Medicare premium support it’s likely that you can cover the majority of seniors for a lot less than Medicare currently costs, plus having some market discipline within the program.

And with that tax-free savings plan you also have a foundation for transitioning out of Social Security, and unloading the staggering liabilities that program imposes on our kids and grandkids.

This plan isn’t perfect, but it’s very good. Jindal might not be a top-tier presidential candidate at this point but this tax plan is worthy of one.

Advertisement

Advertisement