Two of the world’s largest oilfield service companies say a shale crash is coming.

While financially troubled oilfield service providers attempt to stay afloat, “financial markets aren’t lending their support.” Lance Loeffler, chief financial officer at Houston-based Halliburton, said on a webcast.

Halliburton, which leads the world in fracking, anticipates that nearly two thirds of rigs in the region might be shut down by the last quarter of the year. Schlumberger, the world’s biggest overall oilfield services provider, said it has already cut its spending by 30 percent in 2020.

“At its worst, the U.S. rig count could see a 70% drop over a six-month period, eclipsing the greater than 60% cut in 1986,” according to a report by Raymond James Financial, a Florida-based multinational independent investment bank.

“We believe OFS companies and investors need to prepare themselves for activity to fall at an unprecedented rate,” Praveen Narra, an analyst at Raymond James, wrote Monday. “We believe that E&Ps attention to free cash flow, as well as several with credit issues, will force spending reductions that are far more drastic than in previous downcycles.”

“Having collapsed by about 60 percent this year, Brent and West Texas Intermediate crude have stabilized at around $25 a barrel, but the price rout is far deeper for actual cargoes, which are changing hands at large and widening discounts to the global benchmarks,” Bloomberg reports. The discounts in reality mean that some crude streams are trading at $15, $10 and $8 a barrel.

“The physical market is in pain, and there is more pain to come,” Torbjorn Tornqvist, co-founder of the large trading house Gunvor Group, said. “We will see the full weight of the oversupply in a couple of weeks.”

Crude oil trades at a premium or discount to Brent, West Texas Intermediate and other benchmarks. When there are surpluses, premiums narrow and discounts widen. “But the current situation is almost unprecedented, with discounts in some cases at multi-decade highs,” Bloomberg reports.

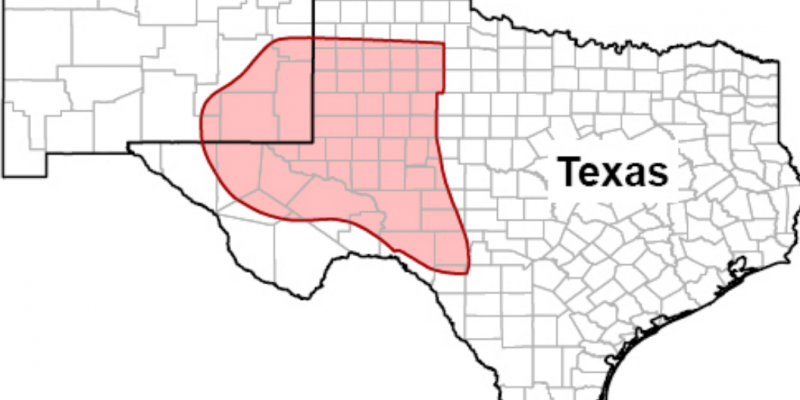

Oil and gas companies began reducing operations in the Permian Basin in response to the spread of the novel coronavirus slowing global energy demands, which contributes to the price of oil dropping.

The Houston-based Apache Corporation announced it is pulling all of its oil and gas rigs out of the Permian Basin to save on short-term spending, according to Carlsbad Current-Argus. The company plans to reduce its 2020 capital investment by almost $1 billion, reducing its Permian rig count to zero.

Pioneer Natural Resources, one of the largest acreage holders in the region, which operates mostly in the Delaware Basin (on the western side of the Permian Basin), announced it cut operations by half. Rig count was reduced to 11 from 22, completion crews to two from six. And its capital budget was cut by 45 percent.

This article was first published by The Center Square.

Advertisement

Advertisement