Yes, crashes and burns. We spent much of the day talking to Republican House members, and right now there is a better likelihood than ever that the entire budget negotiation officially implodes.

Here’s what’s happening at the Capitol nobody but our readers will know about – because the legacy media’s coverage of the budget negotiations is predictably one-sided and shallow, when it’s not downright rotten.

The fundamental dynamic of this session is what it’s always been – which is that Gov. John Bel Edwards and his administration have taken the position that they’ve cut as much of the budget as they can possibly cut, even though the budget is almost $5 billion larger than it was when he took office. As such, Edwards is demanding the full $650 million in tax increases from the legislature and threatening to veto any budget which isn’t built on tax hikes of that size.

This has created a major impasse for the legislature to overcome in trying to craft a compromise. Namely, this – it is impossible to get a two-thirds majority for $650 million in tax increases in either house of the Louisiana legislature at present. There are 61 Republicans out of 105 House members and 25 Republicans in the 39-member Senate. Not all of those Republican legislators are die-hard fiscal conservatives by any means, but essentially to pass a tax increase such a bill will have to have the full support of all of the Democrats and then get 30 Republicans to sign on in the House.

And it is possible to get that number for a tax bill. There are 30 Republicans who will vote for a renewal of the temporary sales taxes passed in 2016 – on a temporary basis. And they’ll renew maybe half of the one cent of sales taxes passed that year; a half-cent MIGHT pass, while something less would likely get suitable Republican votes to pass under the usual formula.

That’s why there is a bill set to be heard in House Ways and Means tomorrow – that would be HB 27 by House Republican delegation chair Lance Harris – which would renew a third of a penny of that sales tax and have it be temporary – it sunsets in five years. The fiscal note on Harris’ bill is $366 million, which essentially meets Edwards halfway on his demands.

Seeing as though it’s Harris’ bill, it’s a reasonably decent bet that’s the House leadership’s effort at forging a compromise.

But here’s the problem. That bill won’t pass unless the Legislative Black Caucus agrees to support it, and right now there is zero indication from the Black Caucus that they will.

This is what blew up the first special session of the year. The Black Caucus refuses to support any sales tax renewals in the belief that their constituents, who somehow are all dirt-poor and without means of survival save for government assistance (or at least that’s what we’d be led to believe based on the songs they sing), pay a disproportionate amount of sales taxes. They don’t, of course, but that’s what they believe. Therefore, the Black Caucus has been screaming all year that what they want is income taxes and business taxes rather than sales taxes.

There is virtually no support for income taxes among the House Republicans.

Alternatively, there is another “solution” the Black Caucus has signaled it would be willing to accept if sales taxes are all that is in play. Two weeks ago the far-left Louisiana Budget Project put out a policy brief touting the benefits of pumping up Louisiana’s Earned Income Tax Credit program to 10 percent of the federal credit – which is an $83 million giveaway to the poor that would most certainly be “refundable” – meaning you could catch a check for the credit without actually paying anything in taxes. And the Budget Project then offered up a 3/4-penny sales tax increase as an idea for balancing the budget – which would be a $689 million tax increase.

That’s a $600 million tax-and-redistribute plan which would pay for more or less all of Edwards’ spending wishes. The Black Caucus has demands beyond that idea, though.

We’re told that in the budget negotiations so far between the House leadership and Edwards, the governor has been dismissive of the idea that he doesn’t have the Black Caucus. He’s repeatedly assured the House leadership that “they’ll come around.” The House leaders are talking to the Black Caucus as well, though, and they’re repeatedly told that coming around is NOT the direction the Caucus is moving in.

Again, this is how the first special session imploded. Edwards had no votes he could bring to the table that could create a consensus.

So by Friday, when it’s expected some of the tax bills would hit the House floor, we’ll know whether the first pitfall toward a successful compromise – whether it’s Harris’ bill for a third of a penny or something else – can be cleared. If the Black Caucus refuses to back a sales tax bill, don’t be surprised if the whole session collapses and House Speaker Taylor Barras just adjourns it with the full support of the majority.

But there’s another problem even if the Black Caucus comes along on a sales tax bill, which is that Edwards wants his full $650 million. What the House can’t do is pass something – Harris $366 million, let’s say – and bring it to Edwards as what it thinks is a meet-in-the-middle compromise, only to have him veto the budget because they haven’t satisfied the rest of his demands. That’s why during today’s Ways and Means hearing Edwards’ commissioner of administration Jay Dardenne was repeatedly asked what budget amount short of $650 million in new taxes would be suitable to survive his veto pen, and why there was so much consternation when Dardenne refused to answer the question.

Advertisement

There is zero trust for Edwards within the House Republicans, and many of them are fully suspicious of a potential bait and switch by the governor. And while you’d think an action like refusing to sign a budget containing half the new taxes he wants would be political suicide, he already vetoed the regular session budget, which most of them thought was just short of insane given the timeline having to start over would impose on them in a two-week special session.

As of now there is no budget bill. There won’t be one anytime soon, either, because the budget can’t move until the Revenue Estimating Committee recognizes the revenue any tax increase bills would generate. Something would have to pass and then the REC could plug its numbers in, and THEN a budget bill could begin moving.

Whereas Edwards could have signed the regular-session budget and given the legislature something to work with while its special session purview could have been to pass some tax increases to fund a supplemental budget filling whatever funding gaps exist.

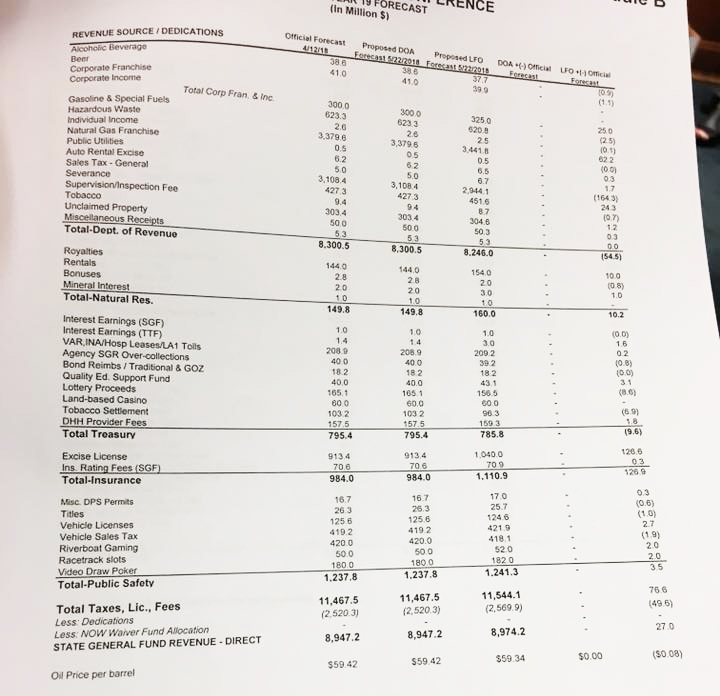

And to indicate just how dysfunctional this whole relationship is, Edwards is adhering to this $650 million deficit number when there isn’t even a consensus for that. The House Republicans say the real number is $495 million, which they come about based on the following…

FY 19 Forecast: $8,947b

FY 18 Budget: 9.461b

Difference: ($514m)

Minus Carry Forward: $19m

Shortfall = ($495m)

Not to mention that when the REC sent up its latest projections those were wholly unchanged from its last numbers of April 12, and as such there is no recognition of the runup in oil prices – Louisiana Light Crude traded at $78.24 on Tuesday, which is about $19 per barrel higher than the $59.42 the REC’s projections have it.

In Ways and Means today Dardenne was asked about when the REC would recognize more revenue from oil prices. The old rule has always been that when oil rises a dollar in prices, over the course of a year that comes to $12 million in revenue to the Louisiana treasury, and in the committee it was discussed that because of falling production the number is now more like $8 million.

But at $8 million with a $19 difference, that’s $152 million in revenue not being projected that would come in for the next fiscal year. Assuming, of course, that the price stays what it is now. Most analysis we’ve seen indicates oil prices are more likely to rise rather than fall over the next year given political instability in Venezuela and Iran and the accelerating U.S. economy.

Not recognizing the oil revenue is a sign the House Republicans are taking as bad faith by the administration, and that added to the budget veto has them ready to go home. If Ways and Means lets a revenue bill out with the support of the Republican delegation and the Black Caucus kills it on Friday, a crash and burn is the likely result.

And again, the Black Caucus is acting as though it has leverage over both the governor and the Republicans. That’s quite possibly a misread of its position and a recipe for an even bigger disaster in this special session than their intransigence caused back in March.

Advertisement

Advertisement